Managed CCWaaS vs In‑House Automation: Cost, Risk and Speed Trade‑Offs

Managed CCWaaS is often superior to in-house automation for routine billing and collections, offering faster deployment and lower risk. Prioritize speed and auditability over code control to reduce costs and maintenance burdens.

Most operations leaders can describe their collections and billing pain in detail. The sticking point is how to fix it without creating new work. This article compares managed CCWaaS vs in house automation for routine billing and collections, so you can weigh cost, risk, and speed to value with real numbers, not guesswork.

We’ll walk you through what actually breaks in DIY builds, what regulators and auditors expect, and where a managed approach eliminates hidden work. We’ll discuss the specific ways integration, idempotent writebacks, and evidence capture determine outcomes more than flow design ever will. You’ll leave with a practical decision model you can defend.

Key Takeaways:

For repeatable billing and collections cases, pick resolution speed and auditability over code control.

Integration ownership and guaranteed writebacks decide outcomes, not flow authorship.

Expect 2 to 6 weeks to pilot with managed CCWaaS vs 12 to 24 weeks in house for the same scope.

Total cost of ownership turns on maintenance: connectors, schema drift, reauth, and policy updates.

Track completion rate, time to resolution, writeback success, and deflection to measure impact.

Use managed services when evidence capture and retention must withstand audits without rework.

Why managed CCWaaS vs in house automation is not a close call for routine billing

For routine billing and collections, managed CCWaaS vs in house automation is rarely a tie. Managed approaches ship faster, reduce unit cost, and lower risk because they own integration and writebacks end to end. In house builds often win on flexibility, but they absorb a maintenance tax that compounds across channels, policies, and systems. For standard workflows, resolution speed beats control.

The badge of control hides a maintenance tax

Owning the code feels safer. It also means you own connector upkeep, schema drift, authentication rotation, and policy changes across systems that rarely move in sync. Most teams underestimate how often upstream providers tweak responses or credentials. Each change adds tickets, rework, and risk of partial writes that agents must untangle.

That tax grows as volume rises. A single failed payment flow might look simple on a whiteboard. At scale, it touches batch files, SOAP services, REST APIs, and policy engines. Every dependency introduces a new way to fail. The result is more time spent on plumbing and less on outcomes that matter, like completed payments and lower unit cost.

The prize in routine, policy‑bound work is consistent resolution at scale. Bespoke portals and custom flows can impress, but if they lead to context switches and manual wrap‑up, they waste cycles. When the message is the app and outcomes write back automatically, queues shrink and audit questions get easier. Control for its own sake adds cost without improving completion.

After all that, you might ask what leaders actually buy. Speed or sovereignty?

What do leaders really buy, speed or sovereignty?

Speed to resolution drives cost and customer outcomes. Sovereignty over code is only useful if it improves those numbers. In regulated environments, governance and auditability are non‑negotiable. You can buy them as an outcome with SLAs, or you can rebuild them internally and carry the ongoing risk.

Managed CCWaaS packages resilience the way your business needs it: adapters that survive upstream changes, idempotent writebacks, and logs that stand up to scrutiny. Those aren’t nice‑to‑haves. They are the difference between a straight‑through resolution and a week of reconciliation. If your objective is faster time to value and lower unit cost, code control is the wrong proxy for success.

When you treat sovereignty as a requirement, be precise. Do you need unique product logic that truly can’t be modeled in rules? Or do you need predictable evidence capture, consistency, and scale? Most billing and collections flows fit the latter. That is why routine work favors managed outcomes over DIY control.

The real blocker behind managed CCWaaS vs in house automation decisions: integration and compliance proof

The main blocker is integration with guaranteed writebacks and audit‑ready evidence, not flow design. No‑code tools draw boxes and arrows well. Enterprise operations hinge on idempotency, mixed transport layers, and immutable logs aligned to policy. When those fail, teams pay in exceptions, rework, and regulatory risk. Managed adapters and retention policies turn that risk into a contract.

Integration is the hard part, not drawing flows

Drawing the flow is easy. Closing the loop across legacy cores, modern APIs, message queues, and batch files is where DIY efforts struggle. Idempotent writebacks ensure a payment or plan posts once and only once, even when networks flicker. Authentication rotation and secrets hygiene prevent silent failures that surface as bad data later.

These are engineering problems with real operational costs. Miss an idempotency guard and you risk duplicate postings. Skip schema validation and you create partial records that break downstream logic. Thin logging means your audit pull spans three tools and a pile of screenshots. Foundational guidance like NIST’s log management recommendations explains why structured, tamper‑evident logs matter across the lifecycle.

Designing flows won’t save a brittle integration. Owning adapters, retries, and telemetry does. That is what separates conversations from completion.

Why do DIY flows stall at the writeback?

DIY stacks often change context at the decision moment. A chat points to a portal. A portal points to a call. Each hop increases abandonment, and even when the customer acts, the outcome might not write back cleanly. Partial writes are common when systems disagree on schema or timeouts hit mid‑transaction.

Writeback is where risk clusters. Without idempotency keys and confirmation logs, it is hard to prove what happened. Stripe’s guidance on idempotency keys shows how a simple pattern removes a whole class of failures. Now apply that discipline to every billing and collections writeback across multiple systems and channels. The effort is non‑trivial.

Managed communication layers solve this by owning adapters, event subscriptions, and retries. They confirm outcomes, attach evidence, and post back to systems of record with guarantees. That is how the loop closes without manual wrap‑up.

The numbers that drown the debate: cost, risk, and time for managed CCWaaS vs in house automation

Time to value, total cost of ownership, and audit readiness decide the trade. Managed CCWaaS pilots for failed payments typically launch in 2 to 6 weeks because vendors own integration and policy modeling. Comparable in house efforts take 12 to 24 weeks due to access, security review, connector build, portal changes, and QA. Those timeline gaps translate directly into cost and opportunity lost.

Time to value benchmarks that withstand scrutiny

Pilots move fastest when the vendor already has adapters and a rules engine. They connect to your triggers, encode policy, and validate writebacks without waiting for app teams to change portals. Two to six weeks is a realistic window to launch a targeted, high‑volume use case when integration is handled for you.

In house teams must navigate environment access, security reviews, data contracts, and portal teams’ backlogs. Even with strong leadership, 12 to 24 weeks is common for the same scope. That delay isn’t a failure of talent. It reflects real constraints: change windows, shared services queues, and testing across systems. Speed matters because every month without resolution automation means more agent minutes and higher unit cost.

It is better to be honest about these gates upfront. Shortening them requires owning fewer of them. That is what a managed approach buys you.

Full loaded TCO and the long tail of maintenance

Licenses look clean on a spreadsheet. The long tail lives in tickets. Every upstream change triggers connector updates, regression testing, and monitoring. Secrets must rotate. Policies evolve. Each tweak risks schema mismatches and edge‑case failures that agents or engineers must unwind.

That ongoing work shows up in real ways:

Engineering time to maintain and extend connectors across REST, SOAP, batch, and queues

QA cycles after vendor API changes or new policy rules

Monitoring and alerting for retries, errors, and drift across environments

Manual reconciliation when partial writes or missing documents slip through

Managed services concentrate that burden into a single SLA and vendor responsibility. You still govern outcomes, but you don’t carry the platform tax that eats capacity each quarter.

Compliance and audit readiness as real line items

Evidence capture isn’t a report you pull the day before an audit. It is a design requirement. You need consent timestamps, identity proofs, documents, transaction outcomes, and writeback confirmations with retention policies. Ad hoc exports are fragile and often incomplete under scrutiny.

Regulators and auditors expect traceable evidence chains that hold up without manual stitching. Think of the structure inside formal packets, where source documents, approvals, and outcomes align step by step. Even this wildlife permit packet shows the level of completeness reviewers expect across complex submissions: [example of a comprehensive evidence bundle]. Your operations logs should mirror that discipline so investigations close quickly and findings don’t escalate.

When logging and retention are built in, audits become validation rather than reconstruction. That shift saves time, lowers risk, and protects trust.

Life on the ground when the system is yours to keep alive

Day to day reality decides whether a choice holds. In house ownership means your team fields after‑hours pages for failed writes, agents toggle between systems while customers wait, and managers chase exceptions that should have resolved automatically. That drag raises error rates and moves experts away from non‑routine work where judgment matters most.

The human cost of brittle integrations

Engineers don’t measure success by flow screenshots. They count nights without pages. Brittle integrations add stress, especially when failures are intermittent. A missing idempotency guard duplicates a payment once a week. A rotated certificate breaks a writeback for a subset of customers. Investigations spread across teams and tools while backlogs grow.

Agents feel it too. Instead of resolving complex disputes, they rekey data and explain portal detours. Managers spend mornings building exception lists and afternoons chasing owners. It is not a lack of effort. It is a structural problem that pushes routine, policy‑bound work to people and creates more chances to get it wrong.

Teams deserve systems that default to resolution. People should handle exceptions, not carry the process.

How does this feel for customers and agents?

Customers receive more reminders than ever. The friction appears right when it is time to act. A login they forgot. A switch from SMS to a portal. A chat that escalates to a call. Each extra step invites abandonment. That abandonment shows up as missed payments, longer cycles, and calls that cost more than the problem they solve.

Agents burn out when predictable work crowds out complex cases. Leaders face monthly surprises in unit cost and clearance rates. No one is failing on purpose. The model is wrong for the job. Routine work needs completion in channel with automatic writebacks. That is how both experiences and metrics improve at the same time.

The new operating model for managed CCWaaS vs in house automation decisions

A better model focuses on resolution inside the message, not conversations about resolution. Start with a single, high‑volume, policy‑bound workflow. Define completion data and evidence first. Keep the experience channel‑native so customers act where they already are. Use the results to scale what works and reserve DIY for rare, high‑complexity logic.

Start with one high volume, policy bound workflow

Pick failed payments or standard payment plans. These flows are repeatable, measurable, and important. Define what counts as completion, which fields must write back, and which consents or documents prove the change. Pilot with a cohort large enough to show signal without adding risk.

Measure the right numbers: completion rate, time to resolution, writeback success, and deflection. Those metrics connect directly to cost to serve. If deflection rises and time to resolution falls, you are reducing queues and freeing agents for exceptions.

Scale based on data, not appetite. Let results, not enthusiasm, drive the next use case.

Design from the outcome backward

Start with policy and evidence. Which eligibility rules apply? Which documents or attestations are required? Which system fields must change, and how will you confirm success? When you model that first, the rest follows.

Outreach should point to an embedded, secure mini‑app inside SMS, email, or WhatsApp. Identity validates in flow. The app presents only actions the policy allows, like update card, set plan, or upload documents. Avoid portal detours. Every context switch risks abandonment and manual wrap‑up that inflates cost. Official guidance like NIST SP 800‑63 digital identity reinforces why strong, in‑flow identity proofing reduces risk without adding new apps.

When customers act where they already are, completion rises and support traffic falls.

Build a decision matrix you can defend

Create a rubric that shows where each approach wins. Compare build vs buy across time to value, maintenance burden, evidence capture, integration ownership, scalability under spikes, and total unit cost. Mark the thresholds where in house control is necessary, like highly unusual product logic or ultra‑specific security constraints.

Then be clear about the rest:

Use managed CCWaaS for routine, policy‑bound flows where evidence and writebacks matter most

Keep DIY for rare cases with non‑standard logic you can’t encode in rules

Revisit decisions quarterly as policies, volumes, and upstream systems change

A decision matrix turns preference into governance. It also helps you explain choices to risk and audit partners before they ask.

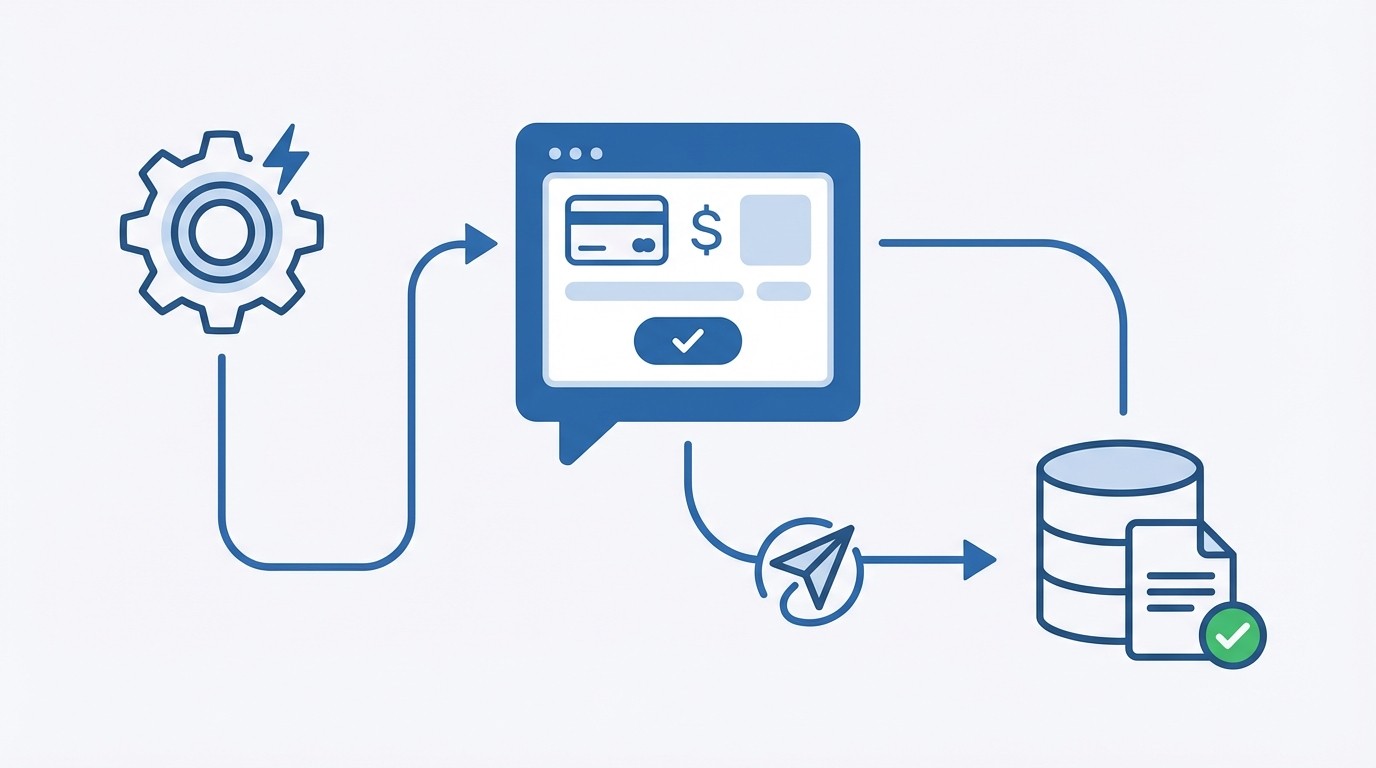

How RadMedia operationalizes a managed CCWaaS for billing and collections

RadMedia delivers a resolution‑first service that closes the loop inside the message. It connects triggers from your systems to channel‑native mini‑apps, executes policy on autopilot, and writes outcomes back with guarantees. That is how teams cut integration lead time from months to weeks and stop paying the reconciliation tax that raises unit cost.

Managed integration with writeback guarantees

RadMedia owns connectivity to REST, SOAP, message queues, webhooks, and SFTP, including authentication management and schema mapping. When a customer completes a task, RadMedia posts the outcome back to your systems of record with idempotency keys, retries, and telemetry so results are consistent even during network issues.

This is the practical answer to the writeback stall. The platform confirms outcomes, stores context, and synchronizes updates so agents don’t chase partial records. It is also the transformation callback to earlier costs: fewer maintenance tickets, fewer regression cycles after upstream changes, and less manual reconciliation that inflates unit cost.

RadMedia brings structure to what used to be drift, which is why time to pilot lands in weeks, not quarters.

In message self service and autopilot orchestration

Customers act inside SMS, email, or WhatsApp using secure, no‑download mini‑apps. Identity verifies in flow with one‑time codes or known‑fact checks. The app exposes only actions that match policy, such as update card, select a compliant payment plan, confirm details, or upload documents. The Autopilot engine sequences outreach, enforces rules, and escalates only when exceptions occur.

The payoff is visible in operations metrics. Teams report significant contact center deflection and faster cycle times when routine cases resolve automatically. In many deployments, contact center load drops sharply while payments completed rise because customers finish tasks without logins or channel switches. Exceptions reach agents with full context, not a blank screen.

When routine resolution becomes the default, people can focus on the work only people can do.

Closed‑loop visibility and audit readiness

RadMedia logs consent timestamps, identity proofs, documents, transaction outcomes, and writeback confirmations with retention policies. Each step includes telemetry for monitoring and analytics. That design turns audit pulls into straightforward exports rather than investigations across tools.

The outcome is predictable evidence that stands up to review. Instead of assembling screenshots, you provide a complete chain of records tied to each case. Reviewers can trace what happened, when, and why. That reliability reduces rework, shortens investigations, and lowers regulatory exposure.

RadMedia was built for teams that measure completion, time to resolution, writeback success, and deflection. Those are the numbers that move cost to serve and customer outcomes.

Conclusion

You don’t have to choose control or outcomes for everything. For routine, policy‑bound billing and collections work, managed CCWaaS vs in house automation isn’t close once you account for integration ownership, idempotent writebacks, and evidence capture. The maintenance tax of DIY builds is real, and it grows over time.

Start with one high‑volume workflow. Define completion and evidence first. Keep the experience channel‑native so customers act where they already are. Measure completion rate, time to resolution, writeback success, and deflection. If those numbers move in the right direction, expand the managed approach and reserve DIY for rare logic you truly can’t encode. That is how you reduce unit cost, lower risk, and deliver faster outcomes without adding headcount.

Discover the pros and cons of managed CCWaaS vs in-house automation for billing. Learn how to reduce costs and improve speed to value effectively.

Managed CCWaaS vs In‑House Automation: Cost, Risk and Speed Trade‑Offs - RadMedia professional guide illustration

[{"q":"How do I integrate RadMedia with existing systems?","a":"Integrating RadMedia with your existing systems is straightforward. First, identify the core platforms you want to connect, such as billing or collections systems. RadMedia manages the integration process for you, utilizing REST, SOAP, or webhooks to ensure seamless connectivity. Once the integration is set up, you can define actionable triggers like failed payments or due dates. This allows RadMedia to personalize outreach and automate workflows effectively. With RadMedia handling the back-end integration, you can focus on optimizing your customer communication workflows without the hassle of complex coding or maintenance."},{"q":"What if my customers prefer different communication channels?","a":"RadMedia excels in omni-channel communication, meaning you can reach your customers through their preferred channels, whether it's SMS, email, or WhatsApp. To implement this, you can configure channel preferences at the customer or segment level within RadMedia. The system adapts to consent status and known responsiveness, ensuring that messages are sent at optimal times. This flexibility not only improves engagement but also enhances the overall customer experience by allowing them to interact in the way they find most convenient."},{"q":"Can I automate customer self-service tasks?","a":"Absolutely! With RadMedia, you can automate various customer self-service tasks directly within the communication channels. This is done using secure, no-download mini-apps embedded in your messages. Customers can update payment details, set payment plans, or confirm their identity without leaving the conversation. To set this up, you'll need to define the specific actions that align with your policies and customer needs. RadMedia handles the execution, ensuring that outcomes are written back to your systems automatically, which streamlines the entire process."},{"q":"When should I consider using RadMedia for compliance tasks?","a":"Consider using RadMedia for compliance tasks when you need to ensure that processes like KYC refreshes are handled efficiently and securely. RadMedia's in-message self-service apps allow customers to verify their identity and submit necessary documents without switching contexts. This not only speeds up the compliance process but also captures digital consent and audit logs automatically. If your organization is facing challenges with compliance due to fragmented workflows or manual processes, implementing RadMedia can help streamline these tasks and reduce operational risk."},{"q":"Why does my team need RadMedia for billing and collections?","a":"Your team can benefit from RadMedia for billing and collections by leveraging its managed services that handle integration and automate workflows end-to-end. This means you can reduce the time and cost associated with manual processes. RadMedia's system allows for closed-loop resolution, where tasks are completed directly within messages, eliminating the need for portals or manual follow-ups. By adopting RadMedia, you can improve efficiency, reduce operational costs, and enhance customer satisfaction through faster resolution times."}]

16 Feb 2026

9e318966-c10a-4267-8c43-9028ed1e082d

{"@graph":[{"@id":"https://radmedia.co.za/managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs#article","@type":"Article","image":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs-hero-1771249703477.png","author":{"name":"RadMedia","@type":"Organization"},"headline":"Managed CCWaaS vs In‑House Automation: Cost, Risk and Speed Trade‑Offs","keywords":"managed CCWaaS vs in-house automation","publisher":{"name":"RadMedia","@type":"Organization"},"wordCount":2754,"description":"Managed CCWaaS vs In‑House Automation: Cost, Risk and Speed Trade‑Offs","dateModified":"2026-02-16T13:48:03.661+00:00","datePublished":"2026-02-16T13:44:00.574014+00:00","mainEntityOfPage":{"@id":"https://radmedia.co.za/managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs","@type":"WebPage"}},{"@id":"https://radmedia.co.za/managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs#breadcrumb","@type":"BreadcrumbList","itemListElement":[{"item":"https://radmedia.co.za","name":"Home","@type":"ListItem","position":1},{"item":"https://radmedia.co.za/managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs","name":"Managed CCWaaS vs In‑House Automation: Cost, Risk and Speed ","@type":"ListItem","position":2}]}],"@context":"https://schema.org"}

[{"url":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs-inline-0-1771249719163.png","alt":"How RadMedia operationalizes a managed CCWaaS for billing and collections concept illustration - RadMedia","filename":"managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs-inline-0-1771249719163.png","position":"after_h2_1","asset_id":null,"type":"ai_generated","dimensions":{"width":1024,"height":1024}},{"url":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs-inline-1-1771249741016.png","alt":"Life on the ground when the system is yours to keep alive concept illustration - RadMedia","filename":"managed-ccwaas-vs-in-house-automation-cost-risk-and-speed-trade-offs-inline-1-1771249741016.png","position":"after_h2_2","asset_id":null,"type":"ai_generated","dimensions":{"width":1024,"height":1024}}]

88

2754

Most operations leaders can describe their collections and billing pain in detail. The sticking point is how to fix it without creating new work. This article compares managed CCWaaS vs in house automation for routine billing and collections, so you can weigh cost, risk, and speed to value with real numbers, not guesswork.

We’ll walk you through what actually breaks in DIY builds, what regulators and auditors expect, and where a managed approach eliminates hidden work. We’ll discuss the specific ways integration, idempotent writebacks, and evidence capture determine outcomes more than flow design ever will. You’ll leave with a practical decision model you can defend.

Key Takeaways:

For repeatable billing and collections cases, pick resolution speed and auditability over code control.

Integration ownership and guaranteed writebacks decide outcomes, not flow authorship.

Expect 2 to 6 weeks to pilot with managed CCWaaS vs 12 to 24 weeks in house for the same scope.

Total cost of ownership turns on maintenance: connectors, schema drift, reauth, and policy updates.

Track completion rate, time to resolution, writeback success, and deflection to measure impact.

Use managed services when evidence capture and retention must withstand audits without rework.

Why managed CCWaaS vs in house automation is not a close call for routine billing

For routine billing and collections, managed CCWaaS vs in house automation is rarely a tie. Managed approaches ship faster, reduce unit cost, and lower risk because they own integration and writebacks end to end. In house builds often win on flexibility, but they absorb a maintenance tax that compounds across channels, policies, and systems. For standard workflows, resolution speed beats control.

The badge of control hides a maintenance tax

Owning the code feels safer. It also means you own connector upkeep, schema drift, authentication rotation, and policy changes across systems that rarely move in sync. Most teams underestimate how often upstream providers tweak responses or credentials. Each change adds tickets, rework, and risk of partial writes that agents must untangle.

That tax grows as volume rises. A single failed payment flow might look simple on a whiteboard. At scale, it touches batch files, SOAP services, REST APIs, and policy engines. Every dependency introduces a new way to fail. The result is more time spent on plumbing and less on outcomes that matter, like completed payments and lower unit cost.

The prize in routine, policy‑bound work is consistent resolution at scale. Bespoke portals and custom flows can impress, but if they lead to context switches and manual wrap‑up, they waste cycles. When the message is the app and outcomes write back automatically, queues shrink and audit questions get easier. Control for its own sake adds cost without improving completion.

After all that, you might ask what leaders actually buy. Speed or sovereignty?

What do leaders really buy, speed or sovereignty?

Speed to resolution drives cost and customer outcomes. Sovereignty over code is only useful if it improves those numbers. In regulated environments, governance and auditability are non‑negotiable. You can buy them as an outcome with SLAs, or you can rebuild them internally and carry the ongoing risk.

Managed CCWaaS packages resilience the way your business needs it: adapters that survive upstream changes, idempotent writebacks, and logs that stand up to scrutiny. Those aren’t nice‑to‑haves. They are the difference between a straight‑through resolution and a week of reconciliation. If your objective is faster time to value and lower unit cost, code control is the wrong proxy for success.

When you treat sovereignty as a requirement, be precise. Do you need unique product logic that truly can’t be modeled in rules? Or do you need predictable evidence capture, consistency, and scale? Most billing and collections flows fit the latter. That is why routine work favors managed outcomes over DIY control.

The real blocker behind managed CCWaaS vs in house automation decisions: integration and compliance proof

The main blocker is integration with guaranteed writebacks and audit‑ready evidence, not flow design. No‑code tools draw boxes and arrows well. Enterprise operations hinge on idempotency, mixed transport layers, and immutable logs aligned to policy. When those fail, teams pay in exceptions, rework, and regulatory risk. Managed adapters and retention policies turn that risk into a contract.

Integration is the hard part, not drawing flows

Drawing the flow is easy. Closing the loop across legacy cores, modern APIs, message queues, and batch files is where DIY efforts struggle. Idempotent writebacks ensure a payment or plan posts once and only once, even when networks flicker. Authentication rotation and secrets hygiene prevent silent failures that surface as bad data later.

These are engineering problems with real operational costs. Miss an idempotency guard and you risk duplicate postings. Skip schema validation and you create partial records that break downstream logic. Thin logging means your audit pull spans three tools and a pile of screenshots. Foundational guidance like NIST’s log management recommendations explains why structured, tamper‑evident logs matter across the lifecycle.

Designing flows won’t save a brittle integration. Owning adapters, retries, and telemetry does. That is what separates conversations from completion.

Why do DIY flows stall at the writeback?

DIY stacks often change context at the decision moment. A chat points to a portal. A portal points to a call. Each hop increases abandonment, and even when the customer acts, the outcome might not write back cleanly. Partial writes are common when systems disagree on schema or timeouts hit mid‑transaction.

Writeback is where risk clusters. Without idempotency keys and confirmation logs, it is hard to prove what happened. Stripe’s guidance on idempotency keys shows how a simple pattern removes a whole class of failures. Now apply that discipline to every billing and collections writeback across multiple systems and channels. The effort is non‑trivial.

Managed communication layers solve this by owning adapters, event subscriptions, and retries. They confirm outcomes, attach evidence, and post back to systems of record with guarantees. That is how the loop closes without manual wrap‑up.

The numbers that drown the debate: cost, risk, and time for managed CCWaaS vs in house automation

Time to value, total cost of ownership, and audit readiness decide the trade. Managed CCWaaS pilots for failed payments typically launch in 2 to 6 weeks because vendors own integration and policy modeling. Comparable in house efforts take 12 to 24 weeks due to access, security review, connector build, portal changes, and QA. Those timeline gaps translate directly into cost and opportunity lost.

Time to value benchmarks that withstand scrutiny

Pilots move fastest when the vendor already has adapters and a rules engine. They connect to your triggers, encode policy, and validate writebacks without waiting for app teams to change portals. Two to six weeks is a realistic window to launch a targeted, high‑volume use case when integration is handled for you.

In house teams must navigate environment access, security reviews, data contracts, and portal teams’ backlogs. Even with strong leadership, 12 to 24 weeks is common for the same scope. That delay isn’t a failure of talent. It reflects real constraints: change windows, shared services queues, and testing across systems. Speed matters because every month without resolution automation means more agent minutes and higher unit cost.

It is better to be honest about these gates upfront. Shortening them requires owning fewer of them. That is what a managed approach buys you.

Full loaded TCO and the long tail of maintenance

Licenses look clean on a spreadsheet. The long tail lives in tickets. Every upstream change triggers connector updates, regression testing, and monitoring. Secrets must rotate. Policies evolve. Each tweak risks schema mismatches and edge‑case failures that agents or engineers must unwind.

That ongoing work shows up in real ways:

Engineering time to maintain and extend connectors across REST, SOAP, batch, and queues

QA cycles after vendor API changes or new policy rules

Monitoring and alerting for retries, errors, and drift across environments

Manual reconciliation when partial writes or missing documents slip through

Managed services concentrate that burden into a single SLA and vendor responsibility. You still govern outcomes, but you don’t carry the platform tax that eats capacity each quarter.

Compliance and audit readiness as real line items

Evidence capture isn’t a report you pull the day before an audit. It is a design requirement. You need consent timestamps, identity proofs, documents, transaction outcomes, and writeback confirmations with retention policies. Ad hoc exports are fragile and often incomplete under scrutiny.

Regulators and auditors expect traceable evidence chains that hold up without manual stitching. Think of the structure inside formal packets, where source documents, approvals, and outcomes align step by step. Even this wildlife permit packet shows the level of completeness reviewers expect across complex submissions: [example of a comprehensive evidence bundle]. Your operations logs should mirror that discipline so investigations close quickly and findings don’t escalate.

When logging and retention are built in, audits become validation rather than reconstruction. That shift saves time, lowers risk, and protects trust.

Life on the ground when the system is yours to keep alive

Day to day reality decides whether a choice holds. In house ownership means your team fields after‑hours pages for failed writes, agents toggle between systems while customers wait, and managers chase exceptions that should have resolved automatically. That drag raises error rates and moves experts away from non‑routine work where judgment matters most.

The human cost of brittle integrations

Engineers don’t measure success by flow screenshots. They count nights without pages. Brittle integrations add stress, especially when failures are intermittent. A missing idempotency guard duplicates a payment once a week. A rotated certificate breaks a writeback for a subset of customers. Investigations spread across teams and tools while backlogs grow.

Agents feel it too. Instead of resolving complex disputes, they rekey data and explain portal detours. Managers spend mornings building exception lists and afternoons chasing owners. It is not a lack of effort. It is a structural problem that pushes routine, policy‑bound work to people and creates more chances to get it wrong.

Teams deserve systems that default to resolution. People should handle exceptions, not carry the process.

How does this feel for customers and agents?

Customers receive more reminders than ever. The friction appears right when it is time to act. A login they forgot. A switch from SMS to a portal. A chat that escalates to a call. Each extra step invites abandonment. That abandonment shows up as missed payments, longer cycles, and calls that cost more than the problem they solve.

Agents burn out when predictable work crowds out complex cases. Leaders face monthly surprises in unit cost and clearance rates. No one is failing on purpose. The model is wrong for the job. Routine work needs completion in channel with automatic writebacks. That is how both experiences and metrics improve at the same time.

The new operating model for managed CCWaaS vs in house automation decisions

A better model focuses on resolution inside the message, not conversations about resolution. Start with a single, high‑volume, policy‑bound workflow. Define completion data and evidence first. Keep the experience channel‑native so customers act where they already are. Use the results to scale what works and reserve DIY for rare, high‑complexity logic.

Start with one high volume, policy bound workflow

Pick failed payments or standard payment plans. These flows are repeatable, measurable, and important. Define what counts as completion, which fields must write back, and which consents or documents prove the change. Pilot with a cohort large enough to show signal without adding risk.

Measure the right numbers: completion rate, time to resolution, writeback success, and deflection. Those metrics connect directly to cost to serve. If deflection rises and time to resolution falls, you are reducing queues and freeing agents for exceptions.

Scale based on data, not appetite. Let results, not enthusiasm, drive the next use case.

Design from the outcome backward

Start with policy and evidence. Which eligibility rules apply? Which documents or attestations are required? Which system fields must change, and how will you confirm success? When you model that first, the rest follows.

Outreach should point to an embedded, secure mini‑app inside SMS, email, or WhatsApp. Identity validates in flow. The app presents only actions the policy allows, like update card, set plan, or upload documents. Avoid portal detours. Every context switch risks abandonment and manual wrap‑up that inflates cost. Official guidance like NIST SP 800‑63 digital identity reinforces why strong, in‑flow identity proofing reduces risk without adding new apps.

When customers act where they already are, completion rises and support traffic falls.

Build a decision matrix you can defend

Create a rubric that shows where each approach wins. Compare build vs buy across time to value, maintenance burden, evidence capture, integration ownership, scalability under spikes, and total unit cost. Mark the thresholds where in house control is necessary, like highly unusual product logic or ultra‑specific security constraints.

Then be clear about the rest:

Use managed CCWaaS for routine, policy‑bound flows where evidence and writebacks matter most

Keep DIY for rare cases with non‑standard logic you can’t encode in rules

Revisit decisions quarterly as policies, volumes, and upstream systems change

A decision matrix turns preference into governance. It also helps you explain choices to risk and audit partners before they ask.

How RadMedia operationalizes a managed CCWaaS for billing and collections

RadMedia delivers a resolution‑first service that closes the loop inside the message. It connects triggers from your systems to channel‑native mini‑apps, executes policy on autopilot, and writes outcomes back with guarantees. That is how teams cut integration lead time from months to weeks and stop paying the reconciliation tax that raises unit cost.

Managed integration with writeback guarantees

RadMedia owns connectivity to REST, SOAP, message queues, webhooks, and SFTP, including authentication management and schema mapping. When a customer completes a task, RadMedia posts the outcome back to your systems of record with idempotency keys, retries, and telemetry so results are consistent even during network issues.

This is the practical answer to the writeback stall. The platform confirms outcomes, stores context, and synchronizes updates so agents don’t chase partial records. It is also the transformation callback to earlier costs: fewer maintenance tickets, fewer regression cycles after upstream changes, and less manual reconciliation that inflates unit cost.

RadMedia brings structure to what used to be drift, which is why time to pilot lands in weeks, not quarters.

In message self service and autopilot orchestration

Customers act inside SMS, email, or WhatsApp using secure, no‑download mini‑apps. Identity verifies in flow with one‑time codes or known‑fact checks. The app exposes only actions that match policy, such as update card, select a compliant payment plan, confirm details, or upload documents. The Autopilot engine sequences outreach, enforces rules, and escalates only when exceptions occur.

The payoff is visible in operations metrics. Teams report significant contact center deflection and faster cycle times when routine cases resolve automatically. In many deployments, contact center load drops sharply while payments completed rise because customers finish tasks without logins or channel switches. Exceptions reach agents with full context, not a blank screen.

When routine resolution becomes the default, people can focus on the work only people can do.

Closed‑loop visibility and audit readiness

RadMedia logs consent timestamps, identity proofs, documents, transaction outcomes, and writeback confirmations with retention policies. Each step includes telemetry for monitoring and analytics. That design turns audit pulls into straightforward exports rather than investigations across tools.

The outcome is predictable evidence that stands up to review. Instead of assembling screenshots, you provide a complete chain of records tied to each case. Reviewers can trace what happened, when, and why. That reliability reduces rework, shortens investigations, and lowers regulatory exposure.

RadMedia was built for teams that measure completion, time to resolution, writeback success, and deflection. Those are the numbers that move cost to serve and customer outcomes.

Conclusion

You don’t have to choose control or outcomes for everything. For routine, policy‑bound billing and collections work, managed CCWaaS vs in house automation isn’t close once you account for integration ownership, idempotent writebacks, and evidence capture. The maintenance tax of DIY builds is real, and it grows over time.

Start with one high‑volume workflow. Define completion and evidence first. Keep the experience channel‑native so customers act where they already are. Measure completion rate, time to resolution, writeback success, and deflection. If those numbers move in the right direction, expand the managed approach and reserve DIY for rare logic you truly can’t encode. That is how you reduce unit cost, lower risk, and deliver faster outcomes without adding headcount.