How a Retail Bank Resolved 200k Campaign Failures with In‑Message Instant Apps (Case Study)

A major South African retail bank resolved 200k campaign failures by integrating in-message instant apps, reducing customer abandonment from over 50% to successful resolutions. Key takeaways include validating capacity before scaling and designing workflows for resolution first.

Most operations teams learn this the hard way: scaling a voice-driven campaign can break before you see the upside. A major retail bank in South Africa took a stable SMS-to-call program to 200,000 messages a month and watched abandonment soar. They recovered by moving resolution into the channel with in-message instant apps, not by adding more lines or more agents. We will walk you through what failed, how to spot it early, and the practical design of a resolution-first workflow.

We will discuss the specific ways in-message instant apps remove last-mile friction, reduce unit cost, and protect compliance. You will see where the queues formed, why customers who wanted to pay still failed, and how closed-loop writebacks changed the math. The steps are repeatable across billing, collections, and compliance without big-bang rebuilds.

Key Takeaways:

Validate contact capacity and queue SLAs before scaling any voice flow, or you risk paying for outreach that cannot convert

Track abandonment, average speed of answer, queue time distribution, and intent-to-resolution conversion to catch failure early

Use in-message instant apps to complete tasks inside the conversation and write outcomes back automatically

Measure resolution-first metrics: completion rate, time to resolution, writeback success, deflection percentage, and recontact rate

Design from the outcome backward, then add identity, consent, and channel sequencing to minimize friction and risk

Straight-through processing deflects routine cases so agents handle informed exceptions instead of predictable work

Voice at Scale Collapsed, In-Message Instant Apps Recovered Outcomes

A voice-heavy campaign failed at 200,000 monthly messages because inbound capacity and queue SLAs broke under load. Abandonment jumped from under 10 percent to over 50 percent as customers waited up to two minutes and dropped. Resolution returned when the bank replaced calls with in-message instant apps that completed payment actions inside the conversation.

What the 200k failure exposed

The fourfold scale-up created a new dependency on inbound lines that were not tested for real-world traffic. Two-minute queues became common, average speed of answer deteriorated, and customers who were ready to pay simply gave up. The result was wasted spend, lost revenue, and a damaged customer experience.

The painful truth was not demand. Customers tried to resolve their accounts. The bottleneck sat in infrastructure and a split journey that forced a channel switch at the exact moment of decision. When half your motivated customers abandon, the cost of recovery multiplies across callbacks, recontacts, and manual reconciliation.

Measure these signals before you scale

You can prevent this mistake by instrumenting the right signals early. Abandonment rate shows where customers lose patience. Average speed of answer and queue time distribution reveal capacity cracks. Call drop patterns and intent-to-resolution conversion connect effort to outcomes.

Compare these measures to a stable baseline. In this case, abandonment under 10 percent at normal volumes became more than 50 percent after scale. If you do not track these metrics, you risk burning budget while losing willing payers. A simple, shared dashboard avoids argument and drives fast decisions.

To operationalize the checks, focus on five measures and how they trend:

Abandonment rate by queue band: under 30 seconds, 30 to 60 seconds, 60 to 120 seconds

Average speed of answer and its variance during peaks

Call drop rate segmented by time-in-queue and time-of-day

Intent captured vs. resolution completed within 24 hours

Agent wrap-up time and recontact rate after first outreach

Why in-message instant apps fit the problem

In-message instant apps remove the last-mile dependency on inbound voice by completing the task where the conversation starts. They are secure, no-download interfaces that let customers pay now, promise to pay, or dispute an amount without switching channels. Completion writes back to systems of record automatically, so the loop closes.

This approach turns outreach into outcomes. It avoids the risk of queues, prevents wasted retries, and protects customer trust under heavy load. Research shows that digital-first banking models that reduce friction outperform peers on speed and cost, especially when journeys avoid context switches, as discussed in Bain’s analysis of retail banking’s digital challenge.

The Real Problem Was Resolution, Not Channel Choice

The core issue was not voice vs. SMS. Resolution failed because completion did not happen where the customer acted. Forcing a jump to a portal or an agent at the moment of decision adds friction, raises cost, and increases error risk.

From symptom to root cause

On the surface, the symptom looked like poor voice performance. The underlying problem was a split journey that asked customers to switch channels to finish a task. That hop introduced passwords, wait times, and retries. Each extra step created a chance to drop off or fail an eligibility check too late.

When teams diagnose the channel instead of the completion point, they choose fixes that miss the mark. Adding agents, rewriting scripts, or changing dialers will not recover conversions if the last mile remains fragmented. The fastest path is building resolution into the message and writing the outcome back automatically.

What “resolution inside the message” really means

Resolution-first operations mean the customer completes the task inside the conversation, and the system writes the result to source systems. Evidence and consent are captured as part of the flow. Only exceptions escalate to people, and those escalations include full context.

This model reduces manual wrap-up, lowers rekeying errors, and produces clean audit trails. It also generalizes across billing, collections, and compliance because most high-volume tasks are structured and policy-bound. The aim is simple: finish where you start, then sync the truth back reliably.

Hidden costs of fragmented workflows

Fragmentation looks small per case and becomes large in aggregate. Handoffs add minutes. Rekeying invites mistakes. Partial actions trigger rework and follow-up that drains capacity quietly. Missing attestations and scattered evidence raise audit risk and remediation cost.

Teams often miss how this tax compounds monthly. More channels without closed-loop resolution create parallel queues, not relief. Customers get more reminders but still face the same last-mile friction when it is time to act, a pattern echoed in industry reporting on mobile banking CX and security.

Quantifying the Cost of Abandonment and Manual Recovery

Abandonment more than quadrupled when queues hit two minutes, which turned a working program into a loss. Lost attempts to resolve, recontacts, and manual wrap-up inflated unit cost per resolution. Moving completion in-message cut agent minutes and stabilized outcomes.

Put numbers to the failure

Start with the simple math. At 200,000 messages, if 20 percent intend to resolve, that is 40,000 attempts. At under 10 percent abandonment, you lose fewer than 4,000. At over 50 percent, you lose more than 20,000. That is a fivefold increase in lost resolution attempts from the same spend.

Now layer in recovery. Each abandoned attempt often triggers callbacks, emails, and agent time. If a manual recovery averages eight minutes of agent effort and two touches, the unit cost climbs fast. A two-minute queue can look small until it multiplies across tens of thousands of cases.

The unit economics of in-message completion

In-message completion changes the denominator. Routine payment plans deflect from agents, agent minutes per case drop, and cycle time shrinks. You should track completion rate, time to resolution, writeback success, deflection percentage, and recontact rate to see where cost falls.

Each metric maps to a lever. Higher completion cuts waste. Faster resolution lowers queues and backlog risk. Better writeback success reduces reconciliation work. Higher deflection frees agents for complex cases. Lower recontact reflects fewer failures and clearer experiences.

Compliance, audit, and risk improvements

Digital consent capture, timestamped logs, and idempotent writebacks reduce audit risk and cleanup costs. When evidence lives with the case and outcomes sync to systems of record, you avoid missing attestations, misapplied payments, and scattered documentation.

Fewer manual touches also mean fewer mistakes. That improves fairness, reduces customer disputes, and limits remediation. Younger customers already expect to resolve disputes digitally, a shift highlighted in reporting on bank-app dispute patterns. Meeting them in-message is safer and faster.

From Two-Minute Queues to Instant Relief with In-Message Instant Apps

Customers went from waiting in long queues to finishing tasks in under a minute. Agents shifted from juggling predictable work to handling exceptions with context. Leaders saw better CX, faster resolution, and cleaner audit trails, which lowered risk and protected brand equity.

What it felt like for customers

Before the pivot, customers dialed, waited, and dropped. Some tried again, only to face the same delays. Others bounced to a portal, got stuck on passwords, and never completed the task. Motivation decayed with each failed attempt, even when the intent to pay was strong.

With in-message instant apps, the flow became simple. A secure link arrived, identity was verified, and the customer chose pay now, promise to pay, or dispute. The action completed inside the message, and a receipt confirmed the outcome. No queuing. No downloads. No confusion.

What it felt like for operations teams

Agents were overwhelmed by predictable cases that consumed time and created variability. They toggled across systems, rekeyed data, and spent minutes on wrap-up. Queues did not fall because every routine case still needed a person to glue systems together.

After the shift, straight-through processing handled the majority. Queues thinned. Exceptions routed to people with full history. Agents started at context instead of discovery. The work became more focused, and the error rate dropped with standard flows and automatic writebacks.

Why this emotional shift matters to executives

Customer relief and agent focus translate into hard outcomes. Better CX reduces churn and complaints. Faster resolution lifts cash flow in collections and billing. Clean audit trails reduce remediation and regulatory risk. Leaders care because these changes move both cost and outcomes.

This is not about replacing people. It is about reserving people for the work only people can do, while systems execute the rest with consistency and speed. That alignment is central to the operational improvements many banks seek, as discussed in McKinsey’s perspective on agentic AI and banking.

Designing the In-Message Instant Apps Resolution Workflow

Design from the outcome backward so every step supports completion and writeback. Define evidence and consent, then layer identity and channel orchestration that keep friction low. The goal is straight-through processing for routine cases and targeted escalations for exceptions.

Map outcomes, then design backward

Start by defining what “done” means for each workflow. In collections, that might be a processed payment, a scheduled promise to pay, or a logged dispute. Document writeback fields, required evidence, and consent language so the system knows exactly what to store and where.

Only then design outreach and in-message steps to achieve that outcome with minimal friction. This sequence prevents scope creep, reduces error, and improves speed to value. It also ensures analytics are tied to meaningful milestones, not superficial conversation metrics.

To structure the build, work in this order:

Define completion states and writeback schema for each path

Specify consent text, evidence artifacts, and retention needs

Map identity proofing level by action sensitivity

Draft in-message flows that present only eligible actions

Configure outreach triggers, timing, and stop conditions

How do you verify identity and keep it simple

Identity should match the sensitivity of the action. One-time codes and known-fact checks are appropriate for low-risk updates. Stronger checks apply when funds move or personal data changes. Keep steps minimal to avoid unnecessary drop-offs while meeting policy and risk needs.

Always capture digital consent and store it with timestamps and identifiers. Present only policy-eligible actions to reduce confusion and error. Design the mini-app to confirm success with a clear receipt so customers trust the outcome. This protects both the customer and the bank.

Orchestrate channels and sequence nudges

Reach customers on the channels they prefer, within quiet hours, and at times they respond. Sequence SMS, email, and WhatsApp based on consent and past responsiveness. Stop the sequence when a writeback confirms completion, not when a click occurs.

Use retries and fallback channels sparingly and with purpose. The aim is completion, not volume. Smart orchestration increases conversion without adding noise, a principle that aligns with patterns reported in mobile banking CX studies.

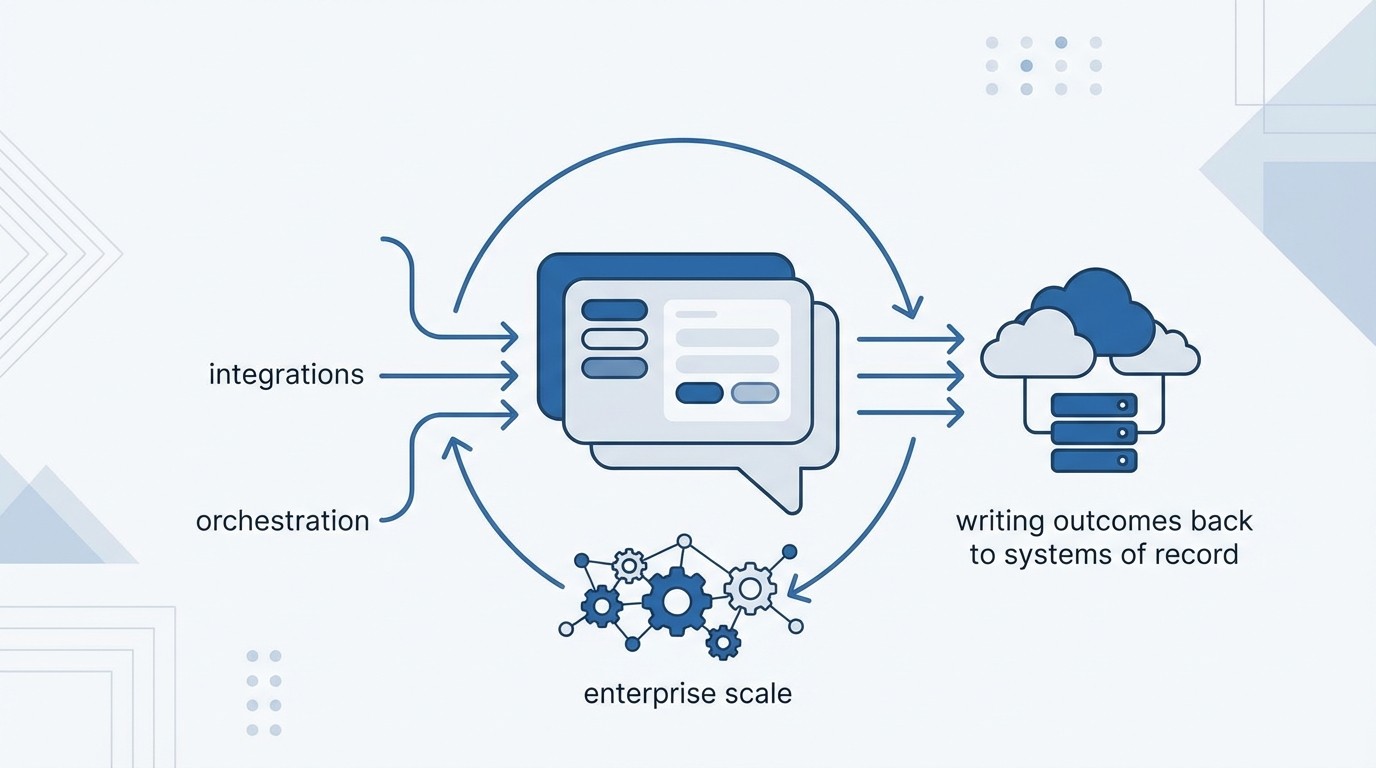

How RadMedia Makes In-Message Instant Apps Real at Enterprise Scale

RadMedia enables closed-loop resolution by managing integrations, orchestrating outreach, delivering secure in-message instant apps, and writing outcomes back to systems of record. The result is fewer queues, lower unit cost, and cleaner audits that map directly to the failure costs described earlier.

Managed integration and writeback guarantees

RadMedia connects to REST and SOAP APIs, message queues, and secure batch files, then manages authentication, schema mapping, and error handling. When a workflow completes, RadMedia writes results back with idempotency and retries so balances update, flags clear, and notes and documents attach without manual wrap-up.

This integration-first approach eliminates the hidden tax of reconciliation and rekeying. It also prevents the queue-driven failures that inflated abandonment earlier. By owning adapters and writebacks, RadMedia removes brittle handoffs and reduces both cost and risk tied to manual recovery.

Autopilot engine, policies, and exception handling

RadMedia models eligibility and rules in an engine that advances workflows based on customer steps or time-based triggers. Routine cases complete straight through, while exceptions escalate to agents with full context, including messages sent, inputs collected, and attempted writebacks.

This deflects predictable volume and reclaims agent time. It also improves accuracy because policies are encoded once instead of buried in scripts. The bank’s earlier queue metrics normalize because the majority of cases no longer depend on inbound lines or manual intervention.

Secure in-message instant apps and audit trails

RadMedia delivers secure, no-download mini-apps inside the message so customers can update details, set plans, confirm identity, upload documents, and sign attestations without switching channels. Identity is verified appropriately, and digital consent is captured and stored alongside case records.

Every step is logged with timestamps. Outcomes write back to systems of record, and evidence is retained for audit. This structure reduces remediation, lowers error rates, and protects CX. It also ensures your resolution metrics, like completion rate and writeback success, improve for the right reasons. With RadMedia, teams launch one high-volume workflow quickly, measure time-to-resolution and deflection, and expand with confidence.

Conclusion

The bank’s story is a clear lesson. Do not scale voice until you have validated capacity and instrumented the right signals. If completion does not happen in the message, you will pay in cost, delay, and lost trust. When in-message instant apps close the loop and outcomes write back automatically, you turn outreach into resolution.

Start small. Define the outcome, design backward, and pilot one high-volume workflow. Measure completion, time to resolution, writeback success, deflection, and recontact. You will see queues shrink, unit cost fall, and audit risk ease as routine cases resolve themselves and people focus on the exceptions that truly need them.

Discover how a South African retail bank resolved 200k campaign failures using in-message instant apps. Learn key strategies and results.

How a Retail Bank Resolved 200k Campaign Failures with In‑Message Instant Apps (Case Study) - RadMedia professional guide illustration

[{"q":"How do I implement in-message instant apps for my campaigns?","a":"To implement in-message instant apps using RadMedia, start by identifying the specific actions you want customers to take, such as making payments or updating information. Next, work with RadMedia to integrate your back-end systems, ensuring that the necessary data flows seamlessly into the instant apps. Finally, design the outreach messages to include secure links to these apps, allowing customers to complete their tasks directly within the conversation, without needing to switch channels or log in."},{"q":"What if my campaign still experiences high abandonment rates?","a":"If you're facing high abandonment rates, consider analyzing your current outreach process. Look for bottlenecks, such as long wait times or complex steps that frustrate customers. You can use RadMedia to automate and streamline these interactions. Implement in-message self-service apps to allow customers to complete tasks without leaving the conversation. This approach typically reduces friction and can significantly lower abandonment rates by providing a smoother, more efficient experience."},{"q":"Can I track the success of my in-message campaigns?","a":"While RadMedia doesn't provide traditional analytics or dashboards, you can measure the success of your in-message campaigns by focusing on key resolution metrics. Track completion rates, time to resolution, and writeback success to understand how well your campaigns are performing. This data can help you identify areas for improvement and optimize your workflows for better outcomes."},{"q":"When should I consider switching to automated resolution workflows?","a":"Consider switching to automated resolution workflows when you notice high volumes of routine inquiries or tasks that can be handled without human intervention. If your current system leads to long queues and frustrated customers, it’s a sign that automation could help. RadMedia’s in-message instant apps allow you to automate common tasks like payment processing and identity verification, freeing up your agents to focus on more complex issues."},{"q":"Why does my team need to focus on resolution metrics?","a":"Focusing on resolution metrics is crucial because it helps you understand how effectively your campaigns are addressing customer needs. Instead of just counting conversations, measure outcomes like completion rates and time to resolution. This shift in focus can reveal inefficiencies in your process and highlight opportunities for improvement. By using RadMedia to automate these workflows, you can enhance customer satisfaction and reduce operational costs."}]

16 Feb 2026

cb518107-358d-466d-a05a-a3ede36d4163

{"@graph":[{"@id":"https://radmedia.co.za/how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study#article","@type":"Article","image":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study-hero-1771250458646.png","author":{"name":"RadMedia","@type":"Organization"},"headline":"How a Retail Bank Resolved 200k Campaign Failures with In‑Message Instant Apps (Case Study)","keywords":"retail bank in-message apps case study","publisher":{"name":"RadMedia","@type":"Organization"},"wordCount":2451,"description":"How a Retail Bank Resolved 200k Campaign Failures with In‑Message Instant Apps (Case Study)","dateModified":"2026-02-16T14:00:37.454+00:00","datePublished":"2026-02-16T13:57:46.675088+00:00","mainEntityOfPage":{"@id":"https://radmedia.co.za/how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study","@type":"WebPage"}},{"@id":"https://radmedia.co.za/how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study#breadcrumb","@type":"BreadcrumbList","itemListElement":[{"item":"https://radmedia.co.za","name":"Home","@type":"ListItem","position":1},{"item":"https://radmedia.co.za/how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study","name":"How a Retail Bank Resolved 200k Campaign Failures with In‑Me","@type":"ListItem","position":2}]}],"@context":"https://schema.org"}

[{"url":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study-inline-0-1771250482030.png","alt":"Designing the In-Message Instant Apps Resolution Workflow concept illustration - RadMedia","filename":"how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study-inline-0-1771250482030.png","position":"after_h2_1","asset_id":null,"type":"ai_generated","dimensions":{"width":1024,"height":1024}},{"url":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study-inline-1-1771250500179.png","alt":"How RadMedia Makes In-Message Instant Apps Real at Enterprise Scale concept illustration - RadMedia","filename":"how-a-retail-bank-resolved-200k-campaign-failures-with-in-message-instant-apps-case-study-inline-1-1771250500179.png","position":"after_h2_2","asset_id":null,"type":"ai_generated","dimensions":{"width":1024,"height":1024}}]

90

2451

Most operations teams learn this the hard way: scaling a voice-driven campaign can break before you see the upside. A major retail bank in South Africa took a stable SMS-to-call program to 200,000 messages a month and watched abandonment soar. They recovered by moving resolution into the channel with in-message instant apps, not by adding more lines or more agents. We will walk you through what failed, how to spot it early, and the practical design of a resolution-first workflow.

We will discuss the specific ways in-message instant apps remove last-mile friction, reduce unit cost, and protect compliance. You will see where the queues formed, why customers who wanted to pay still failed, and how closed-loop writebacks changed the math. The steps are repeatable across billing, collections, and compliance without big-bang rebuilds.

Key Takeaways:

Validate contact capacity and queue SLAs before scaling any voice flow, or you risk paying for outreach that cannot convert

Track abandonment, average speed of answer, queue time distribution, and intent-to-resolution conversion to catch failure early

Use in-message instant apps to complete tasks inside the conversation and write outcomes back automatically

Measure resolution-first metrics: completion rate, time to resolution, writeback success, deflection percentage, and recontact rate

Design from the outcome backward, then add identity, consent, and channel sequencing to minimize friction and risk

Straight-through processing deflects routine cases so agents handle informed exceptions instead of predictable work

Voice at Scale Collapsed, In-Message Instant Apps Recovered Outcomes

A voice-heavy campaign failed at 200,000 monthly messages because inbound capacity and queue SLAs broke under load. Abandonment jumped from under 10 percent to over 50 percent as customers waited up to two minutes and dropped. Resolution returned when the bank replaced calls with in-message instant apps that completed payment actions inside the conversation.

What the 200k failure exposed

The fourfold scale-up created a new dependency on inbound lines that were not tested for real-world traffic. Two-minute queues became common, average speed of answer deteriorated, and customers who were ready to pay simply gave up. The result was wasted spend, lost revenue, and a damaged customer experience.

The painful truth was not demand. Customers tried to resolve their accounts. The bottleneck sat in infrastructure and a split journey that forced a channel switch at the exact moment of decision. When half your motivated customers abandon, the cost of recovery multiplies across callbacks, recontacts, and manual reconciliation.

Measure these signals before you scale

You can prevent this mistake by instrumenting the right signals early. Abandonment rate shows where customers lose patience. Average speed of answer and queue time distribution reveal capacity cracks. Call drop patterns and intent-to-resolution conversion connect effort to outcomes.

Compare these measures to a stable baseline. In this case, abandonment under 10 percent at normal volumes became more than 50 percent after scale. If you do not track these metrics, you risk burning budget while losing willing payers. A simple, shared dashboard avoids argument and drives fast decisions.

To operationalize the checks, focus on five measures and how they trend:

Abandonment rate by queue band: under 30 seconds, 30 to 60 seconds, 60 to 120 seconds

Average speed of answer and its variance during peaks

Call drop rate segmented by time-in-queue and time-of-day

Intent captured vs. resolution completed within 24 hours

Agent wrap-up time and recontact rate after first outreach

Why in-message instant apps fit the problem

In-message instant apps remove the last-mile dependency on inbound voice by completing the task where the conversation starts. They are secure, no-download interfaces that let customers pay now, promise to pay, or dispute an amount without switching channels. Completion writes back to systems of record automatically, so the loop closes.

This approach turns outreach into outcomes. It avoids the risk of queues, prevents wasted retries, and protects customer trust under heavy load. Research shows that digital-first banking models that reduce friction outperform peers on speed and cost, especially when journeys avoid context switches, as discussed in Bain’s analysis of retail banking’s digital challenge.

The Real Problem Was Resolution, Not Channel Choice

The core issue was not voice vs. SMS. Resolution failed because completion did not happen where the customer acted. Forcing a jump to a portal or an agent at the moment of decision adds friction, raises cost, and increases error risk.

From symptom to root cause

On the surface, the symptom looked like poor voice performance. The underlying problem was a split journey that asked customers to switch channels to finish a task. That hop introduced passwords, wait times, and retries. Each extra step created a chance to drop off or fail an eligibility check too late.

When teams diagnose the channel instead of the completion point, they choose fixes that miss the mark. Adding agents, rewriting scripts, or changing dialers will not recover conversions if the last mile remains fragmented. The fastest path is building resolution into the message and writing the outcome back automatically.

What “resolution inside the message” really means

Resolution-first operations mean the customer completes the task inside the conversation, and the system writes the result to source systems. Evidence and consent are captured as part of the flow. Only exceptions escalate to people, and those escalations include full context.

This model reduces manual wrap-up, lowers rekeying errors, and produces clean audit trails. It also generalizes across billing, collections, and compliance because most high-volume tasks are structured and policy-bound. The aim is simple: finish where you start, then sync the truth back reliably.

Hidden costs of fragmented workflows

Fragmentation looks small per case and becomes large in aggregate. Handoffs add minutes. Rekeying invites mistakes. Partial actions trigger rework and follow-up that drains capacity quietly. Missing attestations and scattered evidence raise audit risk and remediation cost.

Teams often miss how this tax compounds monthly. More channels without closed-loop resolution create parallel queues, not relief. Customers get more reminders but still face the same last-mile friction when it is time to act, a pattern echoed in industry reporting on mobile banking CX and security.

Quantifying the Cost of Abandonment and Manual Recovery

Abandonment more than quadrupled when queues hit two minutes, which turned a working program into a loss. Lost attempts to resolve, recontacts, and manual wrap-up inflated unit cost per resolution. Moving completion in-message cut agent minutes and stabilized outcomes.

Put numbers to the failure

Start with the simple math. At 200,000 messages, if 20 percent intend to resolve, that is 40,000 attempts. At under 10 percent abandonment, you lose fewer than 4,000. At over 50 percent, you lose more than 20,000. That is a fivefold increase in lost resolution attempts from the same spend.

Now layer in recovery. Each abandoned attempt often triggers callbacks, emails, and agent time. If a manual recovery averages eight minutes of agent effort and two touches, the unit cost climbs fast. A two-minute queue can look small until it multiplies across tens of thousands of cases.

The unit economics of in-message completion

In-message completion changes the denominator. Routine payment plans deflect from agents, agent minutes per case drop, and cycle time shrinks. You should track completion rate, time to resolution, writeback success, deflection percentage, and recontact rate to see where cost falls.

Each metric maps to a lever. Higher completion cuts waste. Faster resolution lowers queues and backlog risk. Better writeback success reduces reconciliation work. Higher deflection frees agents for complex cases. Lower recontact reflects fewer failures and clearer experiences.

Compliance, audit, and risk improvements

Digital consent capture, timestamped logs, and idempotent writebacks reduce audit risk and cleanup costs. When evidence lives with the case and outcomes sync to systems of record, you avoid missing attestations, misapplied payments, and scattered documentation.

Fewer manual touches also mean fewer mistakes. That improves fairness, reduces customer disputes, and limits remediation. Younger customers already expect to resolve disputes digitally, a shift highlighted in reporting on bank-app dispute patterns. Meeting them in-message is safer and faster.

From Two-Minute Queues to Instant Relief with In-Message Instant Apps

Customers went from waiting in long queues to finishing tasks in under a minute. Agents shifted from juggling predictable work to handling exceptions with context. Leaders saw better CX, faster resolution, and cleaner audit trails, which lowered risk and protected brand equity.

What it felt like for customers

Before the pivot, customers dialed, waited, and dropped. Some tried again, only to face the same delays. Others bounced to a portal, got stuck on passwords, and never completed the task. Motivation decayed with each failed attempt, even when the intent to pay was strong.

With in-message instant apps, the flow became simple. A secure link arrived, identity was verified, and the customer chose pay now, promise to pay, or dispute. The action completed inside the message, and a receipt confirmed the outcome. No queuing. No downloads. No confusion.

What it felt like for operations teams

Agents were overwhelmed by predictable cases that consumed time and created variability. They toggled across systems, rekeyed data, and spent minutes on wrap-up. Queues did not fall because every routine case still needed a person to glue systems together.

After the shift, straight-through processing handled the majority. Queues thinned. Exceptions routed to people with full history. Agents started at context instead of discovery. The work became more focused, and the error rate dropped with standard flows and automatic writebacks.

Why this emotional shift matters to executives

Customer relief and agent focus translate into hard outcomes. Better CX reduces churn and complaints. Faster resolution lifts cash flow in collections and billing. Clean audit trails reduce remediation and regulatory risk. Leaders care because these changes move both cost and outcomes.

This is not about replacing people. It is about reserving people for the work only people can do, while systems execute the rest with consistency and speed. That alignment is central to the operational improvements many banks seek, as discussed in McKinsey’s perspective on agentic AI and banking.

Designing the In-Message Instant Apps Resolution Workflow

Design from the outcome backward so every step supports completion and writeback. Define evidence and consent, then layer identity and channel orchestration that keep friction low. The goal is straight-through processing for routine cases and targeted escalations for exceptions.

Map outcomes, then design backward

Start by defining what “done” means for each workflow. In collections, that might be a processed payment, a scheduled promise to pay, or a logged dispute. Document writeback fields, required evidence, and consent language so the system knows exactly what to store and where.

Only then design outreach and in-message steps to achieve that outcome with minimal friction. This sequence prevents scope creep, reduces error, and improves speed to value. It also ensures analytics are tied to meaningful milestones, not superficial conversation metrics.

To structure the build, work in this order:

Define completion states and writeback schema for each path

Specify consent text, evidence artifacts, and retention needs

Map identity proofing level by action sensitivity

Draft in-message flows that present only eligible actions

Configure outreach triggers, timing, and stop conditions

How do you verify identity and keep it simple

Identity should match the sensitivity of the action. One-time codes and known-fact checks are appropriate for low-risk updates. Stronger checks apply when funds move or personal data changes. Keep steps minimal to avoid unnecessary drop-offs while meeting policy and risk needs.

Always capture digital consent and store it with timestamps and identifiers. Present only policy-eligible actions to reduce confusion and error. Design the mini-app to confirm success with a clear receipt so customers trust the outcome. This protects both the customer and the bank.

Orchestrate channels and sequence nudges

Reach customers on the channels they prefer, within quiet hours, and at times they respond. Sequence SMS, email, and WhatsApp based on consent and past responsiveness. Stop the sequence when a writeback confirms completion, not when a click occurs.

Use retries and fallback channels sparingly and with purpose. The aim is completion, not volume. Smart orchestration increases conversion without adding noise, a principle that aligns with patterns reported in mobile banking CX studies.

How RadMedia Makes In-Message Instant Apps Real at Enterprise Scale

RadMedia enables closed-loop resolution by managing integrations, orchestrating outreach, delivering secure in-message instant apps, and writing outcomes back to systems of record. The result is fewer queues, lower unit cost, and cleaner audits that map directly to the failure costs described earlier.

Managed integration and writeback guarantees

RadMedia connects to REST and SOAP APIs, message queues, and secure batch files, then manages authentication, schema mapping, and error handling. When a workflow completes, RadMedia writes results back with idempotency and retries so balances update, flags clear, and notes and documents attach without manual wrap-up.

This integration-first approach eliminates the hidden tax of reconciliation and rekeying. It also prevents the queue-driven failures that inflated abandonment earlier. By owning adapters and writebacks, RadMedia removes brittle handoffs and reduces both cost and risk tied to manual recovery.

Autopilot engine, policies, and exception handling

RadMedia models eligibility and rules in an engine that advances workflows based on customer steps or time-based triggers. Routine cases complete straight through, while exceptions escalate to agents with full context, including messages sent, inputs collected, and attempted writebacks.

This deflects predictable volume and reclaims agent time. It also improves accuracy because policies are encoded once instead of buried in scripts. The bank’s earlier queue metrics normalize because the majority of cases no longer depend on inbound lines or manual intervention.

Secure in-message instant apps and audit trails

RadMedia delivers secure, no-download mini-apps inside the message so customers can update details, set plans, confirm identity, upload documents, and sign attestations without switching channels. Identity is verified appropriately, and digital consent is captured and stored alongside case records.

Every step is logged with timestamps. Outcomes write back to systems of record, and evidence is retained for audit. This structure reduces remediation, lowers error rates, and protects CX. It also ensures your resolution metrics, like completion rate and writeback success, improve for the right reasons. With RadMedia, teams launch one high-volume workflow quickly, measure time-to-resolution and deflection, and expand with confidence.

Conclusion

The bank’s story is a clear lesson. Do not scale voice until you have validated capacity and instrumented the right signals. If completion does not happen in the message, you will pay in cost, delay, and lost trust. When in-message instant apps close the loop and outcomes write back automatically, you turn outreach into resolution.

Start small. Define the outcome, design backward, and pilot one high-volume workflow. Measure completion, time to resolution, writeback success, deflection, and recontact. You will see queues shrink, unit cost fall, and audit risk ease as routine cases resolve themselves and people focus on the exceptions that truly need them.