Channel Strategies: Scale Communications Without Costs

Scale your communications effectively by focusing on cost per resolution instead of cost per send. Implementing preference modeling and cost-aware routing can reduce expenses and improve outcomes, allowing you to grow outreach without increasing operational costs.

Most teams scale channels before they scale cost intelligence. Messages go out faster, bills creep up, and yet agent queues don’t budge. We’ll walk you through why that happens in finance operations and, more importantly, how to reframe channel planning around cost per resolution—so you can grow outreach without growing opex.

We’ll discuss the specific ways preference modeling, writebacks, and cost-aware routing change the math. The short version: the message has to be the app. If customers can complete the task in-channel and the outcome writes back automatically, retries drop, reconciliation vanishes, and costs fall. It’s practical, not theoretical.

Key Takeaways:

Frame every channel decision around cost per resolution, not cost per send

Make completion inside the message your north-star KPI set

Centralize preference and consent to cut waste and retries

Guarantee writebacks to kill reconciliation and reduce risk

Route by cost, urgency, and risk with smart fallbacks—not by habit

Budget guardrails and telemetry keep spend aligned to outcomes

Busy Channels Without Cost Intelligence Inflate Spend

Scaling channels without cost signals raises spend because volume hides the real driver: completion. When tasks don’t finish in-message, you create follow-ups, manual wrap-up, and rework that erase low per-send rates. A complete baseline must include delivery, engineering, compliance, and writeback costs to show true economics.

What happens when you scale messaging without cost signals?

When you increase sends across SMS, email, and WhatsApp without changing eligibility, cadence, or completion paths, you fund volume—not outcomes. The initial data looks good: more deliveries, more opens. Then reality arrives as follow-up tasks, portal drop-offs, and agent escalations stack up. We’ve seen teams surprised by this more than once.

The blind spot is total cost to serve. Cheap sends feel efficient, but every handoff and portal detour adds minutes and risk. Engineering steps in for schema mismatches. Agents rekey outcomes. Compliance requests audit evidence after the fact. A cost per resolution lens makes this visible and gives you a way to act before budgets are exhausted.

The metric that matters is completion inside the message

Completion inside the message compresses cycle time and deflects routine cases from agents. If customers must jump to a portal or wait for a callback, costs compound with every handoff and verification step. That’s why completion rate, time to resolution, writeback success, and deflection are the primary channel KPIs in finance operations.

Make these your default scorecard. You’ll spot underperforming routes fast and spend less time arguing about vanity metrics like send volume or click rates. Honestly, this shift alone often explains “mystery” bills and flat outcomes. It also tells you where to invest: in-message self-service, identity in-flow, and guaranteed writebacks.

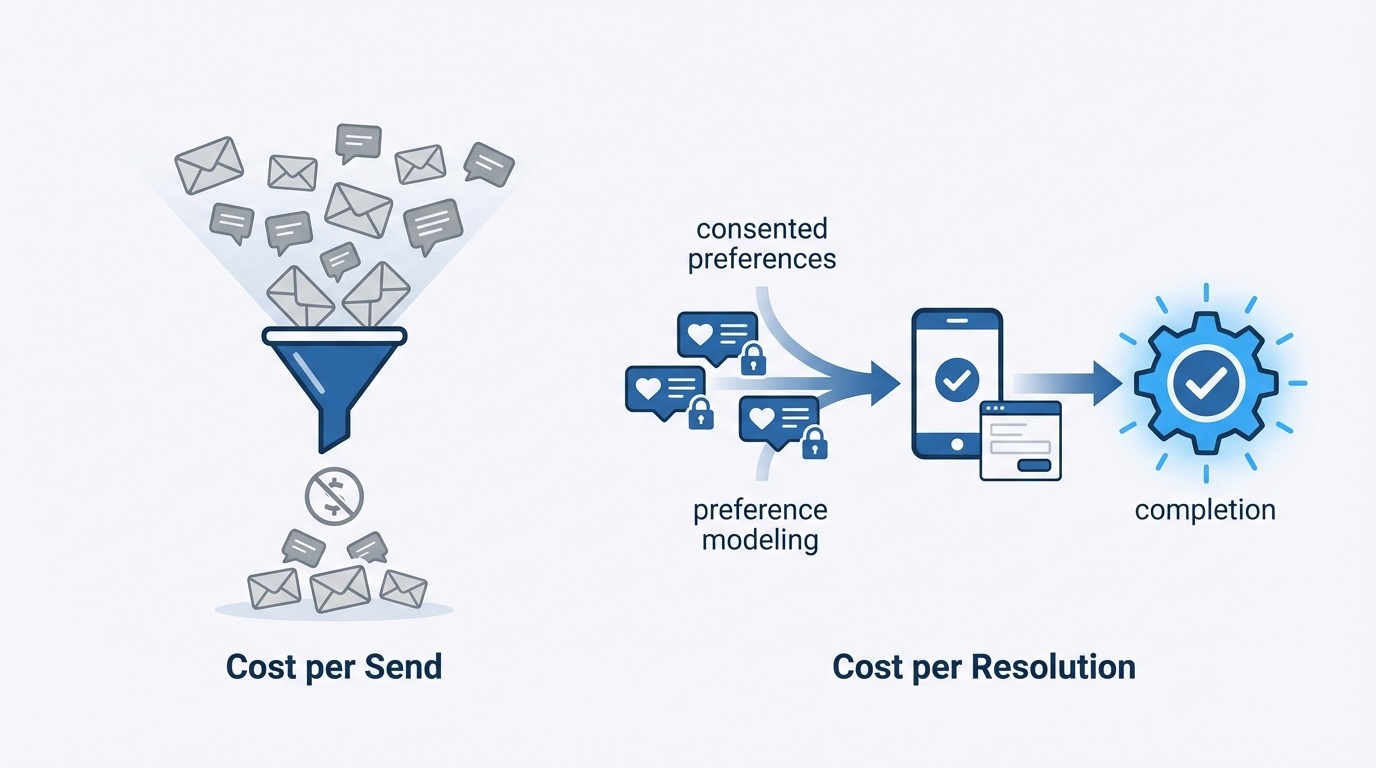

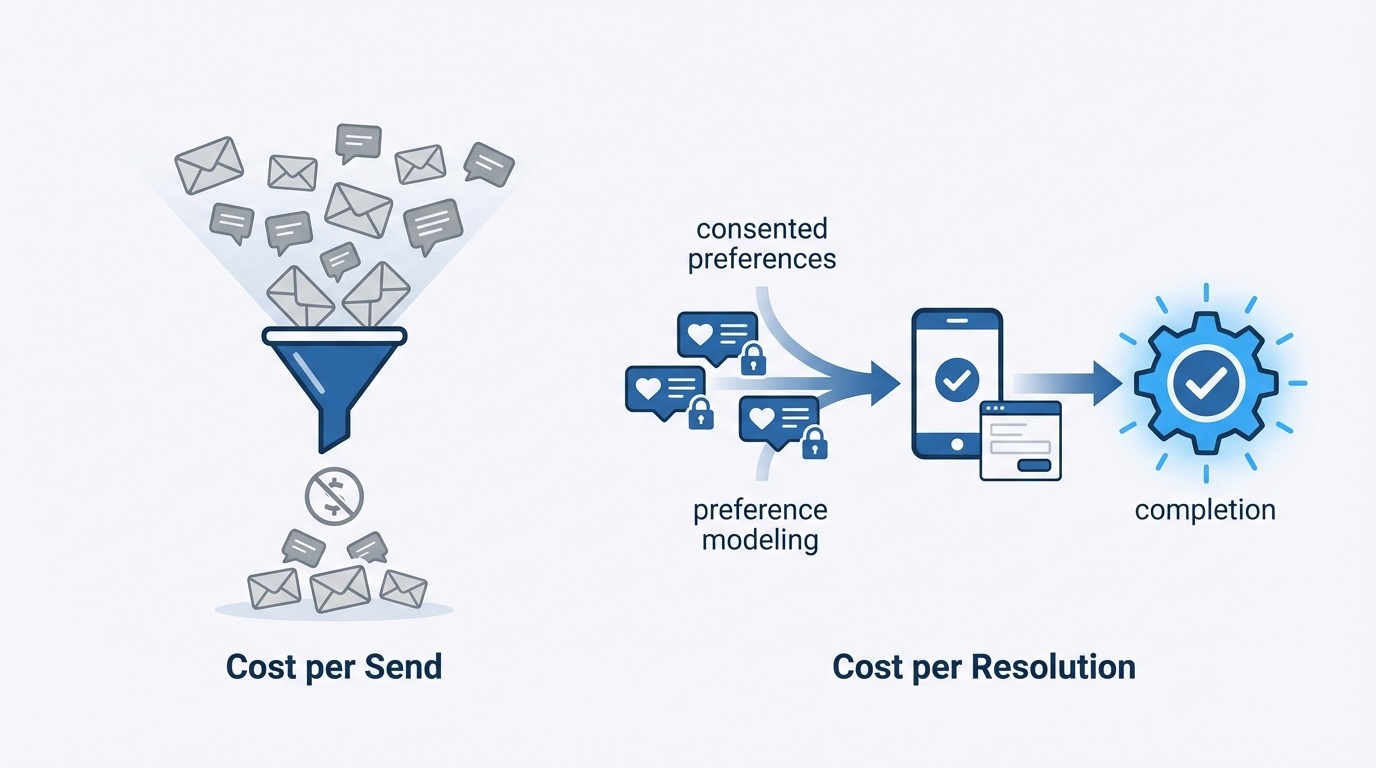

Redefine Efficiency as Cost per Resolution, Not Cost per Send

Efficiency improves when you align outreach with consented preferences and treat messaging as the transaction surface. Preference modeling raises completion by contacting customers where and when they respond. Writeback guarantees remove the hidden cost of reconciliation, which is usually the most expensive step.

Why do preference and consent modeling change the economics?

Preference and consent reduce waste by sending the right message on the right channel at the right time. In practice, that means respecting quiet hours, known responsiveness windows, and channel opt-ins while adapting sequences based on observed behavior. It isn’t just polite. It cuts retries and improves completion.

In finance workflows, merge preference data with eligibility and policy. If a segment consistently resolves via WhatsApp between 8–10 a.m., route there first for eligible cases. Tightly tie this to consent status so you don’t introduce risk while chasing completion. Over time, you’ll see retries fall and unit costs drift down because you aren’t paying for messages that never had a chance to convert.

Integrate writeback so the message is the app

The costliest step is the last mile between customer action and system update. Guaranteeing writebacks from in-message flows to core systems eliminates manual wrap-up, which drives cost-to-serve and introduces risk. This is where idempotency and retries matter. Stripe’s approach to idempotency keys is a good pattern for safe, repeatable writes.

Treat messaging as the transaction surface, not just outreach. When identity, consent capture, and data collection live inside the message, completion rises and errors drop. Then, when outcomes write back to systems of record automatically, agent notes and reconciliation melt away. The unit cost impact is immediate and measurable.

The Hidden Costs Draining Your Communication Budget

Total cost to serve includes engineering hours, reconciliation, and compliance overhead. Fragmented tools and portal detours create shadow work: exports, rekeys, and follow-up calls. These aren’t line items on a carrier invoice, but they’re the reason low per-send rates don’t translate to lower opex.

Engineering hours and reconciliation are part of cost to serve

Fragmented systems push engineers and agents into reconciliation. Every failed API call, schema mismatch, or missing field creates work. These minutes compound across thousands of cases, showing up as delays, inconsistent outcomes, and escalations. It’s tedious, and it’s expensive.

Quantify it. How many hours per month are spent fixing payloads, backfilling fields, or cleaning up errors from brittle integrations? Add those hours to your channel economics. You’ll often find “cheap” channels carry hidden engineering taxes that dwarf send costs. Building for idempotency and automatic retries, as described in AWS’s guidance on safe retries, reduces this burden dramatically.

Compliance, risk, and portal detours outweigh per-message rates

Consent management, audit trails, and evidence capture are non-negotiable in financial services. When channels lack in-flow consent and digital proof, you pay later in exceptions, disputes, and remediation. The UK ICO’s practical guidance on consent is clear: capture it explicitly and store the evidence.

Now add the “portal tax.” Every forced login or app download drops conversion and triggers calls. In collections and billing, even a small drop in completion creates real cash flow impact. Price that impact into your model. Most teams discover that investing in in-message self-service is cheaper than funding avoidable escalations and weekend catch-up shifts.

When Channel Choices Backfire for Finance Operations

Channel choices backfire when spend grows faster than resolution. Expanding sends without completion paths, or pointing to portals for the last mile, drives cost without relieving queues. The fix is boring and powerful: cost-aware routing, in-message completion, and guardrails that cap spend when routes underperform.

The day your SMS bill doubles for no added resolution

A team ramps SMS volume to “reach more customers,” but keeps the same portal link as the action step. Deliveries rise. Completion holds flat. Agents see no relief, reconciliation grows, and finance sees higher opex without revenue lift. This happens more often than anyone admits.

Cost per resolution is the sanity check. If CPR rises while sends spike, pause, inspect eligibility and cadence, and fix the last mile. Route by preference and consent, not guesswork. Replace portal hops with in-message flows. You’ll see retries fall, resolution rise, and the budget stabilize.

When a failed payment spirals into a support backlog

A failed payment triggers email with a portal link. Customers forget passwords and call. Agents verify identity, update details, rekey results, and document outcomes. The backlog grows while unit costs climb. It’s a familiar loop.

Transactional messaging breaks the loop: identity in-flow, payment update inside the message, and guaranteed writebacks. We’ve watched teams cut cycle time dramatically with this alone. Executives care about outcomes, not volume. When you show time-to-resolution dropping and writeback success rising, the conversation changes quickly.

Opti-Channel, Cost-Aware Routing That Protects Engagement

Opti-channel means routing by cost per resolution, preference, urgency, and risk—then completing in-message. We’ll walk you through four strategies that bring control without harming engagement. They’re practical to roll out and measurable within the first month.

Strategy 1: Build a channel scorecard on cost per resolution

Create a scorecard that calculates cost per resolution for SMS, email, and WhatsApp by segment. Include per-send pricing, engineering effort, compliance overhead, retries, and agent follow-ups. Then add conversion and deliverability by segment. This gives you a clear route-to-value view.

Use the scorecard to direct monthly budget allocations and cadences across workflows and value tiers. If SMS resolves mid-value billing tasks at half the CPR of email for Segment A but not B, route accordingly. Set budget caps on routes that underperform. The scorecard becomes your governor and your playbook.

Strategy 2: Model customer channel preferences and consent

Centralize preference and consent at the profile or account level, and keep it fresh with observed behavior. Respect quiet hours. Schedule messages within known responsiveness windows. Update preferences based on what actually resolves, not just declared surveys.

Tie this model to eligibility and policy rules so compliant, high-likelihood actions are presented first. In practice, this means the right channel, at the right time, with the right action—no detours. You’ll reduce retries and escalations naturally because you’re not fighting customer habits or regulatory boundaries.

Strategy 3: Smart fallbacks and in-message completion in one pass

Apply cost-aware routing that considers urgency, risk, and account value, then complete in one pass. For routine, low-risk updates, prioritize low-cost channels first and escalate only if needed. For high-value or time-sensitive events, widen the channel set within budget caps—still aiming to resolve in-message.

Replace portal detours with secure mini-apps for payments, plan setup, KYC, and document capture. Validate identity with one-time codes or known facts. Capture consent in-flow and write back to systems. This combination—smart fallbacks plus in-message completion—cuts retries and shrinks cycle time.

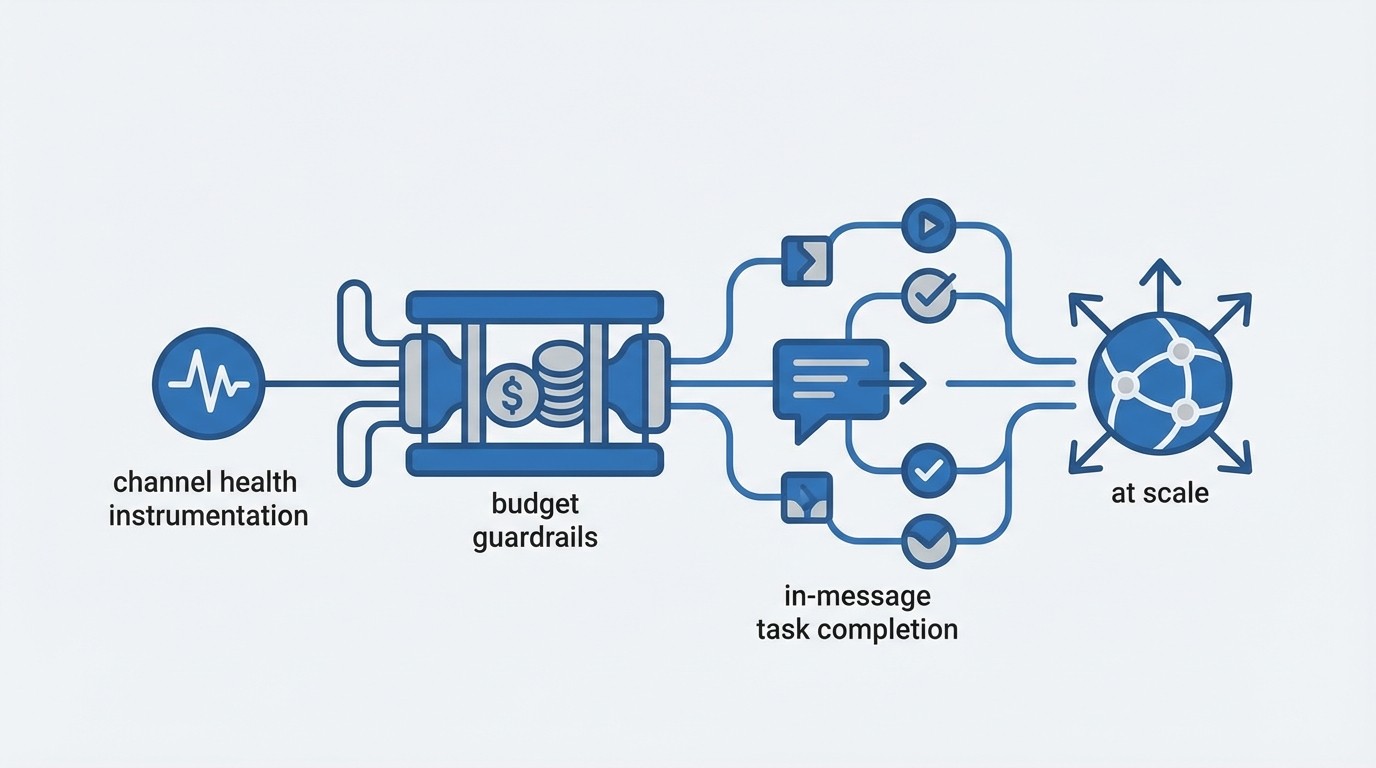

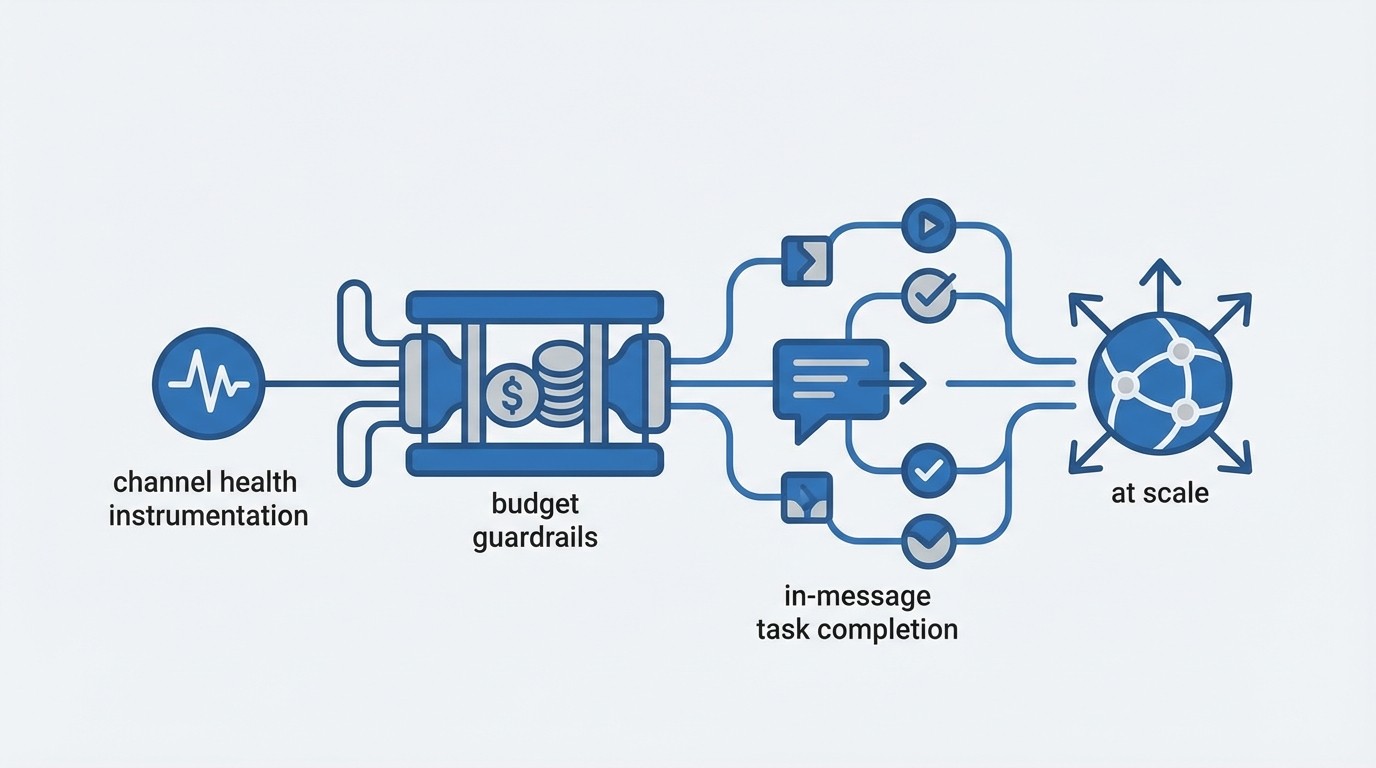

How RadMedia Enables Cost-Aware Opti-Channel at Scale

RadMedia supports cost-aware opti-channel by instrumenting channel health, enforcing budget guardrails, and completing tasks in-message with guaranteed writebacks. The platform connects to legacy cores and modern APIs, orchestrates sequences across SMS, email, and WhatsApp, and writes outcomes back automatically. No portal detours, no manual reconciliation.

Instrument guardrails, policies, and CPR in RadMedia

RadMedia emits telemetry for delivery, completion, writeback success, and deflection per channel and segment, so CPR is visible in real time. You can set budget thresholds and auto-pauses for underperforming routes. When KPIs dip, rules pivot to next-best channels or adjust cadence—without waiting for a weekly review.

Policies map event urgency and account risk to channel sets, cadences, and spend ceilings. For high-value collections, you can expand channels and compress timing. For routine updates, you can constrain to low-cost routes with longer windows. RadMedia’s rules engine enforces these policies consistently, reducing variance and waste. If an exception occurs, escalations hand agents full context—messages, inputs, validation results, and attempted writebacks—so they start at context, not discovery.

Managed integration, consent, and orchestration—end to end

RadMedia manages adapters to legacy cores and modern APIs, authenticates securely, and guarantees idempotent writebacks with retries. Identity is verified in-flow using one-time codes or known-fact validation. Digital consent is captured with timestamps and stored alongside case records for audit. This removes the engineering tax from operations and ensures every completed action updates systems of record with evidence.

Omni-channel orchestration respects quiet hours and preferred windows while adapting to observed completion. Messages personalize with trigger data and point to embedded mini-apps for tasks like payment updates, plan selection, KYC, and document upload. Outcomes write back automatically, deflecting routine cases from agents and shrinking cycle times. If we’re being honest, this is where most teams see the fastest cost relief: no portal hops, fewer retries, and fewer calls.

Conclusion

Opti-channel isn’t “more channels.” It’s routing by cost per resolution, completing in-message, and writing outcomes back automatically. When preference modeling, smart fallbacks, and budget guardrails work together, you protect spend while improving outcomes.

Start with one high-volume workflow. Build a CPR scorecard, route by preference and policy, and replace the portal hop with a mini-app. Measure completion, time-to-resolution, writeback success, and deflection. The economics will be clear—and your queues will be lighter.

Discover effective channel strategies to scale communications while controlling costs. Learn actionable tactics for finance operations today.

Listicle: 6 Channel Strategies to Scale Communications Without Exploding Costs - RadMedia professional guide illustration

[{"q":"How do I set up automated messaging for customer payments?","a":"To set up automated messaging for customer payments, start by identifying the triggers that will initiate the outreach, such as failed payments or upcoming due dates. You can use RadMedia to connect these triggers to your messaging channels like SMS or email. Next, create personalized messages that include a secure link to an in-message self-service app where customers can update their payment details or make payments directly. This way, you ensure that the task can be completed without needing to switch channels or log in elsewhere, enhancing customer experience and reducing operational costs."},{"q":"What if my customers prefer different communication channels?","a":"If your customers have varying preferences for communication channels, you can use RadMedia's omni-channel messaging orchestration. This feature allows you to automate outreach across SMS, email, and WhatsApp, tailoring the messaging based on customer preferences and responsiveness. Set up channel preferences for different customer segments to ensure that messages are sent through the most effective channels. Additionally, you can respect quiet hours and optimize send timing to increase engagement rates and completion of tasks."},{"q":"Can I track the success of my messaging campaigns?","a":"While RadMedia does not provide built-in analytics features, you can measure the success of your messaging campaigns by focusing on completion rates and time-to-resolution. Set clear KPIs that track how many tasks are completed within the messaging channel and how quickly they are resolved. This approach helps you assess the effectiveness of your outreach and identify areas for improvement. You can also gather feedback from customers to understand their experience and adjust your strategies accordingly."},{"q":"When should I consider integrating self-service options?","a":"Consider integrating self-service options when you notice high volumes of routine inquiries or tasks that could be automated. For example, if your customers frequently need to update payment details or verify their identity, using RadMedia's in-message self-service apps can streamline these processes. By allowing customers to complete these tasks within the messaging channel, you reduce the need for agent involvement and improve overall efficiency. This is particularly beneficial during peak times or when managing large volumes of customer interactions."},{"q":"Why does my messaging not lead to task completion?","a":"If your messaging isn't leading to task completion, it may be due to the need for customers to switch channels or log in to external portals. To address this, ensure that your messaging includes in-message self-service options provided by RadMedia. This allows customers to take action directly within the message, reducing friction and increasing the likelihood of completion. Additionally, review your messaging content to ensure it's clear and actionable, encouraging customers to engage and resolve their tasks promptly."}]

27 Jan 2026

7a6ee991-056c-4e0a-b958-62b34c472434

{"@graph":[{"@id":"https://radmedia.co.za/listicle-6-channel-strategies-to-scale-communications-without-exploding-costs#article","@type":"Article","image":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/listicle-6-channel-strategies-to-scale-communications-without-exploding-costs-hero-1769472481108.png","author":{"name":"RadMedia","@type":"Organization"},"headline":"Listicle: 6 Channel Strategies to Scale Communications Without Exploding Costs","keywords":"channel strategies scale communications","publisher":{"name":"RadMedia","@type":"Organization"},"wordCount":1935,"description":"Listicle: 6 Channel Strategies to Scale Communications Without Exploding Costs","dateModified":"2026-01-27T00:04:04.976+00:00","datePublished":"2026-01-27T00:01:58.784594+00:00","mainEntityOfPage":{"@id":"https://radmedia.co.za/listicle-6-channel-strategies-to-scale-communications-without-exploding-costs","@type":"WebPage"}},{"@id":"https://radmedia.co.za/listicle-6-channel-strategies-to-scale-communications-without-exploding-costs#itemlist","name":"Listicle: 6 Channel Strategies to Scale Communications Without Exploding Costs","@type":"ItemList","itemListElement":[{"name":"Busy Channels Without Cost Intelligence Inflate Spend","@type":"ListItem","position":1},{"name":"Redefine Efficiency as Cost per Resolution, Not Cost per Send","@type":"ListItem","position":2},{"name":"The Hidden Costs Draining Your Communication Budget","@type":"ListItem","position":3},{"name":"When Channel Choices Backfire for Finance Operations","@type":"ListItem","position":4},{"name":"Opti-Channel, Cost-Aware Routing That Protects Engagement","@type":"ListItem","position":5},{"name":"How RadMedia Enables Cost-Aware Opti-Channel at Scale","@type":"ListItem","position":6}]},{"@id":"https://radmedia.co.za/listicle-6-channel-strategies-to-scale-communications-without-exploding-costs#breadcrumb","@type":"BreadcrumbList","itemListElement":[{"item":"https://radmedia.co.za","name":"Home","@type":"ListItem","position":1},{"item":"https://radmedia.co.za/listicle-6-channel-strategies-to-scale-communications-without-exploding-costs","name":"Listicle: 6 Channel Strategies to Scale Communications Witho","@type":"ListItem","position":2}]}],"@context":"https://schema.org"}

[{"url":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/listicle-6-channel-strategies-to-scale-communications-without-exploding-costs-inline-0-1769472500888.png","alt":"How RadMedia Enables Cost-Aware Opti-Channel at Scale concept illustration - RadMedia","filename":"listicle-6-channel-strategies-to-scale-communications-without-exploding-costs-inline-0-1769472500888.png","position":"after_h2_1","asset_id":null,"type":"ai_generated","dimensions":{"width":1024,"height":1024}},{"url":"https://jdbrszggncetflrhtwcd.supabase.co/storage/v1/object/public/article-images/6dca98ae-107d-47b7-832f-ee543e4b5364/listicle-6-channel-strategies-to-scale-communications-without-exploding-costs-inline-1-1769472518131.png","alt":"Redefine Efficiency as Cost per Resolution, Not Cost per Send concept illustration - RadMedia","filename":"listicle-6-channel-strategies-to-scale-communications-without-exploding-costs-inline-1-1769472518131.png","position":"after_h2_2","asset_id":null,"type":"ai_generated","dimensions":{"width":1024,"height":1024}}]

96

1935

Most teams scale channels before they scale cost intelligence. Messages go out faster, bills creep up, and yet agent queues don’t budge. We’ll walk you through why that happens in finance operations and, more importantly, how to reframe channel planning around cost per resolution—so you can grow outreach without growing opex.

We’ll discuss the specific ways preference modeling, writebacks, and cost-aware routing change the math. The short version: the message has to be the app. If customers can complete the task in-channel and the outcome writes back automatically, retries drop, reconciliation vanishes, and costs fall. It’s practical, not theoretical.

Key Takeaways:

Frame every channel decision around cost per resolution, not cost per send

Make completion inside the message your north-star KPI set

Centralize preference and consent to cut waste and retries

Guarantee writebacks to kill reconciliation and reduce risk

Route by cost, urgency, and risk with smart fallbacks—not by habit

Budget guardrails and telemetry keep spend aligned to outcomes

Busy Channels Without Cost Intelligence Inflate Spend

Scaling channels without cost signals raises spend because volume hides the real driver: completion. When tasks don’t finish in-message, you create follow-ups, manual wrap-up, and rework that erase low per-send rates. A complete baseline must include delivery, engineering, compliance, and writeback costs to show true economics.

What happens when you scale messaging without cost signals?

When you increase sends across SMS, email, and WhatsApp without changing eligibility, cadence, or completion paths, you fund volume—not outcomes. The initial data looks good: more deliveries, more opens. Then reality arrives as follow-up tasks, portal drop-offs, and agent escalations stack up. We’ve seen teams surprised by this more than once.

The blind spot is total cost to serve. Cheap sends feel efficient, but every handoff and portal detour adds minutes and risk. Engineering steps in for schema mismatches. Agents rekey outcomes. Compliance requests audit evidence after the fact. A cost per resolution lens makes this visible and gives you a way to act before budgets are exhausted.

The metric that matters is completion inside the message

Completion inside the message compresses cycle time and deflects routine cases from agents. If customers must jump to a portal or wait for a callback, costs compound with every handoff and verification step. That’s why completion rate, time to resolution, writeback success, and deflection are the primary channel KPIs in finance operations.

Make these your default scorecard. You’ll spot underperforming routes fast and spend less time arguing about vanity metrics like send volume or click rates. Honestly, this shift alone often explains “mystery” bills and flat outcomes. It also tells you where to invest: in-message self-service, identity in-flow, and guaranteed writebacks.

Redefine Efficiency as Cost per Resolution, Not Cost per Send

Efficiency improves when you align outreach with consented preferences and treat messaging as the transaction surface. Preference modeling raises completion by contacting customers where and when they respond. Writeback guarantees remove the hidden cost of reconciliation, which is usually the most expensive step.

Why do preference and consent modeling change the economics?

Preference and consent reduce waste by sending the right message on the right channel at the right time. In practice, that means respecting quiet hours, known responsiveness windows, and channel opt-ins while adapting sequences based on observed behavior. It isn’t just polite. It cuts retries and improves completion.

In finance workflows, merge preference data with eligibility and policy. If a segment consistently resolves via WhatsApp between 8–10 a.m., route there first for eligible cases. Tightly tie this to consent status so you don’t introduce risk while chasing completion. Over time, you’ll see retries fall and unit costs drift down because you aren’t paying for messages that never had a chance to convert.

Integrate writeback so the message is the app

The costliest step is the last mile between customer action and system update. Guaranteeing writebacks from in-message flows to core systems eliminates manual wrap-up, which drives cost-to-serve and introduces risk. This is where idempotency and retries matter. Stripe’s approach to idempotency keys is a good pattern for safe, repeatable writes.

Treat messaging as the transaction surface, not just outreach. When identity, consent capture, and data collection live inside the message, completion rises and errors drop. Then, when outcomes write back to systems of record automatically, agent notes and reconciliation melt away. The unit cost impact is immediate and measurable.

The Hidden Costs Draining Your Communication Budget

Total cost to serve includes engineering hours, reconciliation, and compliance overhead. Fragmented tools and portal detours create shadow work: exports, rekeys, and follow-up calls. These aren’t line items on a carrier invoice, but they’re the reason low per-send rates don’t translate to lower opex.

Engineering hours and reconciliation are part of cost to serve

Fragmented systems push engineers and agents into reconciliation. Every failed API call, schema mismatch, or missing field creates work. These minutes compound across thousands of cases, showing up as delays, inconsistent outcomes, and escalations. It’s tedious, and it’s expensive.

Quantify it. How many hours per month are spent fixing payloads, backfilling fields, or cleaning up errors from brittle integrations? Add those hours to your channel economics. You’ll often find “cheap” channels carry hidden engineering taxes that dwarf send costs. Building for idempotency and automatic retries, as described in AWS’s guidance on safe retries, reduces this burden dramatically.

Compliance, risk, and portal detours outweigh per-message rates

Consent management, audit trails, and evidence capture are non-negotiable in financial services. When channels lack in-flow consent and digital proof, you pay later in exceptions, disputes, and remediation. The UK ICO’s practical guidance on consent is clear: capture it explicitly and store the evidence.

Now add the “portal tax.” Every forced login or app download drops conversion and triggers calls. In collections and billing, even a small drop in completion creates real cash flow impact. Price that impact into your model. Most teams discover that investing in in-message self-service is cheaper than funding avoidable escalations and weekend catch-up shifts.

When Channel Choices Backfire for Finance Operations

Channel choices backfire when spend grows faster than resolution. Expanding sends without completion paths, or pointing to portals for the last mile, drives cost without relieving queues. The fix is boring and powerful: cost-aware routing, in-message completion, and guardrails that cap spend when routes underperform.

The day your SMS bill doubles for no added resolution

A team ramps SMS volume to “reach more customers,” but keeps the same portal link as the action step. Deliveries rise. Completion holds flat. Agents see no relief, reconciliation grows, and finance sees higher opex without revenue lift. This happens more often than anyone admits.

Cost per resolution is the sanity check. If CPR rises while sends spike, pause, inspect eligibility and cadence, and fix the last mile. Route by preference and consent, not guesswork. Replace portal hops with in-message flows. You’ll see retries fall, resolution rise, and the budget stabilize.

When a failed payment spirals into a support backlog

A failed payment triggers email with a portal link. Customers forget passwords and call. Agents verify identity, update details, rekey results, and document outcomes. The backlog grows while unit costs climb. It’s a familiar loop.

Transactional messaging breaks the loop: identity in-flow, payment update inside the message, and guaranteed writebacks. We’ve watched teams cut cycle time dramatically with this alone. Executives care about outcomes, not volume. When you show time-to-resolution dropping and writeback success rising, the conversation changes quickly.

Opti-Channel, Cost-Aware Routing That Protects Engagement

Opti-channel means routing by cost per resolution, preference, urgency, and risk—then completing in-message. We’ll walk you through four strategies that bring control without harming engagement. They’re practical to roll out and measurable within the first month.

Strategy 1: Build a channel scorecard on cost per resolution

Create a scorecard that calculates cost per resolution for SMS, email, and WhatsApp by segment. Include per-send pricing, engineering effort, compliance overhead, retries, and agent follow-ups. Then add conversion and deliverability by segment. This gives you a clear route-to-value view.

Use the scorecard to direct monthly budget allocations and cadences across workflows and value tiers. If SMS resolves mid-value billing tasks at half the CPR of email for Segment A but not B, route accordingly. Set budget caps on routes that underperform. The scorecard becomes your governor and your playbook.

Strategy 2: Model customer channel preferences and consent

Centralize preference and consent at the profile or account level, and keep it fresh with observed behavior. Respect quiet hours. Schedule messages within known responsiveness windows. Update preferences based on what actually resolves, not just declared surveys.

Tie this model to eligibility and policy rules so compliant, high-likelihood actions are presented first. In practice, this means the right channel, at the right time, with the right action—no detours. You’ll reduce retries and escalations naturally because you’re not fighting customer habits or regulatory boundaries.

Strategy 3: Smart fallbacks and in-message completion in one pass

Apply cost-aware routing that considers urgency, risk, and account value, then complete in one pass. For routine, low-risk updates, prioritize low-cost channels first and escalate only if needed. For high-value or time-sensitive events, widen the channel set within budget caps—still aiming to resolve in-message.

Replace portal detours with secure mini-apps for payments, plan setup, KYC, and document capture. Validate identity with one-time codes or known facts. Capture consent in-flow and write back to systems. This combination—smart fallbacks plus in-message completion—cuts retries and shrinks cycle time.

How RadMedia Enables Cost-Aware Opti-Channel at Scale

RadMedia supports cost-aware opti-channel by instrumenting channel health, enforcing budget guardrails, and completing tasks in-message with guaranteed writebacks. The platform connects to legacy cores and modern APIs, orchestrates sequences across SMS, email, and WhatsApp, and writes outcomes back automatically. No portal detours, no manual reconciliation.

Instrument guardrails, policies, and CPR in RadMedia

RadMedia emits telemetry for delivery, completion, writeback success, and deflection per channel and segment, so CPR is visible in real time. You can set budget thresholds and auto-pauses for underperforming routes. When KPIs dip, rules pivot to next-best channels or adjust cadence—without waiting for a weekly review.

Policies map event urgency and account risk to channel sets, cadences, and spend ceilings. For high-value collections, you can expand channels and compress timing. For routine updates, you can constrain to low-cost routes with longer windows. RadMedia’s rules engine enforces these policies consistently, reducing variance and waste. If an exception occurs, escalations hand agents full context—messages, inputs, validation results, and attempted writebacks—so they start at context, not discovery.

Managed integration, consent, and orchestration—end to end

RadMedia manages adapters to legacy cores and modern APIs, authenticates securely, and guarantees idempotent writebacks with retries. Identity is verified in-flow using one-time codes or known-fact validation. Digital consent is captured with timestamps and stored alongside case records for audit. This removes the engineering tax from operations and ensures every completed action updates systems of record with evidence.

Omni-channel orchestration respects quiet hours and preferred windows while adapting to observed completion. Messages personalize with trigger data and point to embedded mini-apps for tasks like payment updates, plan selection, KYC, and document upload. Outcomes write back automatically, deflecting routine cases from agents and shrinking cycle times. If we’re being honest, this is where most teams see the fastest cost relief: no portal hops, fewer retries, and fewer calls.

Conclusion

Opti-channel isn’t “more channels.” It’s routing by cost per resolution, completing in-message, and writing outcomes back automatically. When preference modeling, smart fallbacks, and budget guardrails work together, you protect spend while improving outcomes.

Start with one high-volume workflow. Build a CPR scorecard, route by preference and policy, and replace the portal hop with a mini-app. Measure completion, time-to-resolution, writeback success, and deflection. The economics will be clear—and your queues will be lighter.